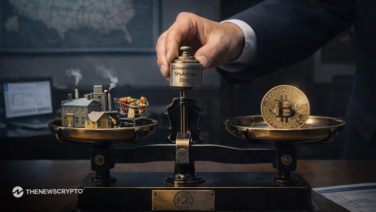

- Crypto is breaking out of speculation as Visa-backed crypto card spending increased 525%.

- Ether.fi dominated crypto card payments with over $55 million in spending.

The people around the World are using the Visa-issued Crypto cards for payments, and this has massively increased in 2025, showing a 525% jump, according to Dune Analytics, which is quietly turning Crypto from an investment to everyday usage.

According to the Dune Analytics Data in 2025, People spending through Visa Crypto cards grew from $14.6 million in January to $91.3 million in transactions in December. This made a huge impact and rise in the real-world crypto payments. People have started buying things with crypto more often and using the Crypto cards like normal debit cards.

Visa’s Backing Fuels EtherFi’s Rise in Crypto Card Payments

The Visa Issued Cards look and work like the Normal Visa Debit cards, which are linked to the Crypto wallets. The users can spend Crypto at the regular stores. Visa is heavily investing in Stablecoins and expanding its partnerships with cryptocurrency. It supports cryptos, keeping Visa at the center of global payments, while the Blockchain technology makes those payments faster, cheaper, and more scalable.

These cards are offered by the Crypto projects and platforms like GnosisPay, Cypher, and Avici Money, but Etherfi was leading the list. The EtherFi Crypto card handled $55.4 million in spending, which is over 60% of all Visa Crypto Card payments. Cypher is followed by $20.5 million. These EtherFi cards make the users spend the value of staked ETH by turning the Locked Crypto into usable money.

These Crypto Cards usages are growing fast due to clear Regulations, Better user experience, Economic Uncertainty, and Visa’s Trusted Payment networks. These together make the Crypto cards easy and safe to use for people around the World. The stablecoin usage is also exploding, and Total Stablecoin Transaction volume crossed $2.5 trillion, where USDT and USDC dominate the usage. Smaller stablecoins are also growing fast, especially for the regional and specialized Use cases.

This shows that the Crypto is no longer speculative; it is being used for travel, online shopping, cross-border payments, etc. So linking these cryptos with the Visa cards may be a faster path to mass adoption. The banks must speed up the Crypto adoption, and the Customer clearly wants Crypto linked payments Options.

Highlighted Crypto News:

Onyxcoin (XCN) Jumps 22%: Can It Keep Flying, or Will Profit-Taking Strike?