- USD0++ depegged after new rules caused panic and losses.

- Usual Protocol introduced fixes like revenue sharing and 1:1 unstaking.

- Protocol’s token, USUAL, dropped in value by 18.7%.

Criticism of Usual Protocol DeFi stablecoin issuance protocol was due to a loss of parity in the staked stablecoin, USD0++. This began depegging on January 9 at a coin level reaching a value of $0.89, while by later stages of recovery. It stood at $0.92 and created fear for both users and cryptospheres.

USD0++ is not an ordinary stablecoin but rather a liquid staking derivative of USD0, somewhat working like stETH when with ETH in Lido Finance. Although USD0 is fully pegged to the US dollar and, therefore, backed by US Treasury bills. USD0++ works more like a bond since users stake USD0 to receive rewards in terms of T-bill yields and the protocol’s native token. USUAL, but the money is locked for four years.

Changes Introduced by Usual Protocol

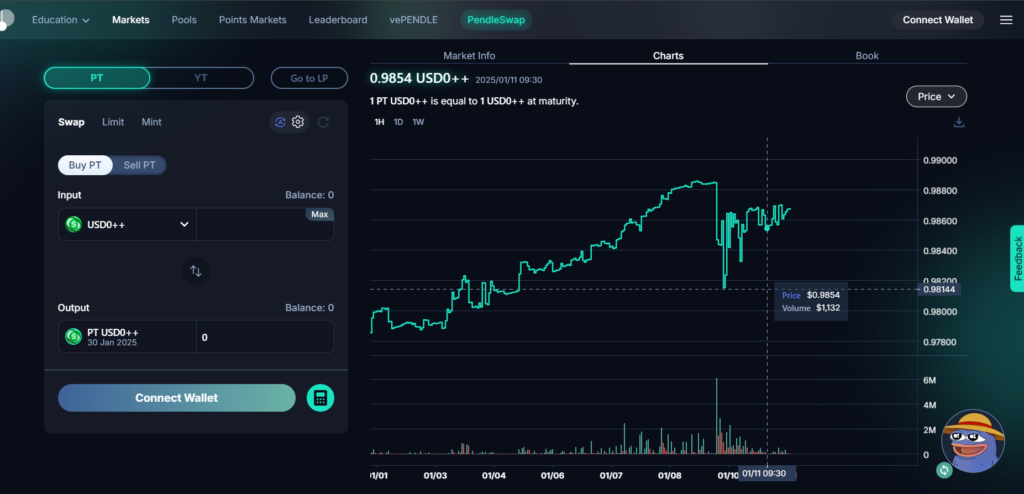

The issue began when Usual Protocol altered the redemption mechanism of USD0++. Previous to this, users could redeem USD0++ at a 1:1 ratio with USD0. This update introduced an alternative redemption mechanism for USD0++ set at a floor price of $0.87. Which is valuing the long-term bond as a discount. This shocked numerous users, causing large liquidations and shifts in liquidity on Curve Finance and Pendle.

To counter this backlash, Usual Protocol has announced several measures. It will activate a “revenue switch” on January 13, sharing earnings from real-world assets and operations with the community. Current conditions will raise returns over 50% annually, generating about $5 million in monthly revenue. These earnings are to be distributed weekly. The protocol will also introduce a “1:1 Early Unstaking” feature that enables users to claim USD0++ at the $1 peg but will penalize them by asking for surrendering their rewards.

The update has been countered by key individuals in the crypto space. Stani Kulechov, Aave founder, criticized the update stating that it exposes the risk of hardcoded price feeds. Michael Egorov, Curve Finance’s founder, was expecting the discount on USD0++ because it is bond-like. But at the same time, he conceded that the sudden change had caught many unprepared. The governance process also came under criticism, as governance is part of the protocol structure, and the owners of USD0++ were not given a say in the vote.

Impact on USUAL Token

USUAL, the native token of the protocol, was not spared from the controversy, and in the last 24 hours, it lost 18.7% of its value. Usual Protocol now faces rebuilding trust and stabilizing its ecosystem. How the team addresses the concerns will define its future in the competitive DeFi space.

Highlighted Crypto News Today

0G Foundation Raises $30.6M in Record-Breaking Decentralized AI Node Sale