- BlackRock’s IBIT had net outflows of $13.51M, marking its first negative flows since May 1.

- Only one spot Bitcoin ETFs, Ark and 21Shares’ ARKB, received $5.34M in net inflows.

The three-day losing skid for U.S. spot bitcoin exchange-traded funds continued on Thursday with net outflows of $71.73 million. Data from SosoValue shows that BlackRock’s IBIT, the biggest spot bitcoin ETF by net assets, had net outflows of $13.51 million, marking its first negative flows since May 1, and second since debut.

On Thursday, $22.68 million left Grayscale’s GBTC, continuing its outflow streak, while $31.11 million left Fidelity’s FBTC. The BITB fund managed by Bitwise also lost $8.09 million, while the BRRR fund managed by Valkyrie lost $1.68 million.

Only one spot Bitcoin ETFs, Ark and 21Shares’ ARKB, received $5.34 million in net inflows. Compared to Wednesday’s total of $2.18 billion, Thursday’s overall trading volume for the 12 spot bitcoin ETFs dropped to $1.64 billion.

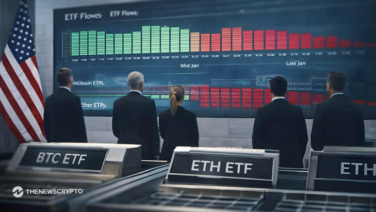

Net Outflows Recorded by Spot Ether ETF

On the other hand, after a day of moderate positive flows, U.S. spot Ethereum ETFs resumed negative flows on Thursday, with net outflows of $1.77 million. Out of all the spot ether ETFs, only Grayscale Ethereum Trust (ETHE) saw outflows of $5.35 million. A net inflow of $3.57 million was received by the Grayscale Ethereum Mini Trust (ETH), which offset this.

On Thursday, no money from the other seven spot ether funds were recorded. After reaching $151.57M on Wednesday, the combined trading volume for all nine ETFs dropped to $95.91M on Thursday.

Amidst the current uncertainty in the cryptocurrency market, Bitcoin (BTC) has seen a precipitous decline, falling from about $65,000 to less than $59,000 in the last few days. Market responses to recent economic data and wider financial trends are among the variables that have contributed to this negative move.

Highlighted Crypto News Today: