- The US Federal Reserve cut lending rate by 25 bps.

- BTC price and ETH price noted an increase in their respective values over the last 24 hours.

- Spot Bitcoin ETF and Spot Ether ETF are expected to correct yesterday’s outflow.

The US Federal Reserve has cut lending rates, signaling that two more cuts could happen by the end of the year. Rate cuts have come amid a softening job market, rising inflation, and political pressure. BTC price and ETH price surged in the last 24 hours, hinting that earlier corrections could be reversed in the days to come. Rate cuts have also triggered anticipation for inflows into Spot BTC ETF and Spot Ether ETF.

Rate Cut by the US Federal Reserve

According to a report by Financial Express, the US Federal Reserve has cut lending rates by 25 bps. This is the first time in 2025 that the US Fed has slashed the rate to bring it within the range of 4.0 – 4.25%. Jerome Powell, Federal Reserve Chair, has hinted that two more cuts of 25 bps are on the table by year-end.

Rate cut by the US Federal Reserve has come due to softening of the job market, which has pointed out a rise in unemployment. Also, the US inflation reached 2.92% as of August 31, 2025, up from 2.70% as of July 31, 2025. Reportedly, the US Federal Reserve decided to cut the lending rate after the political pressure strengthened from the Trump Administration.

Upticks in BTC Price and ETH Price

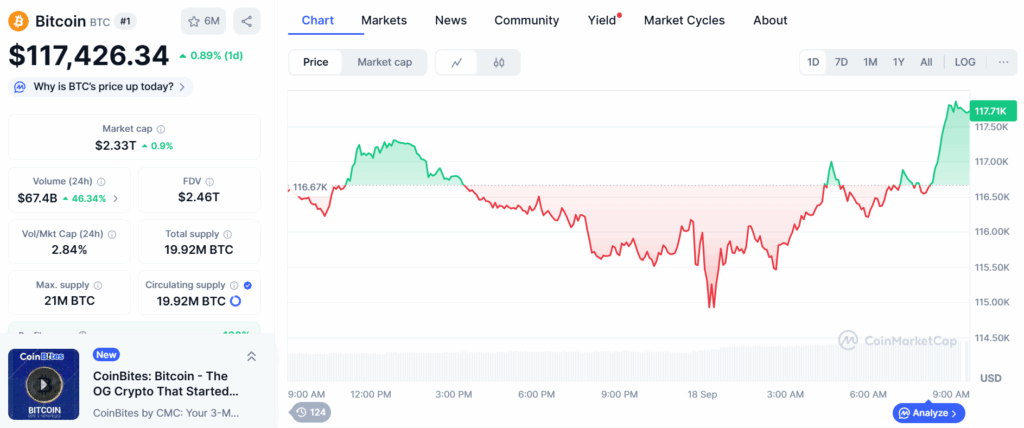

The impact of rate cut is seen on BTC price and ETH price, with both increasing over the last 24 hours. BTC price is $117,426.34, slightly up by 0.89%. It further reflects a rise of 2.88% in the last 7 days, with a significant surge of 46.34% in its 24-hour trading volume.

It is estimated, according to BTC price prediction, that the flagship cryptocurrency will breach the milestone of $121,000 in the next 30 days. However, this may be attributed to the correction phase after BTC price achieves a new ATH.

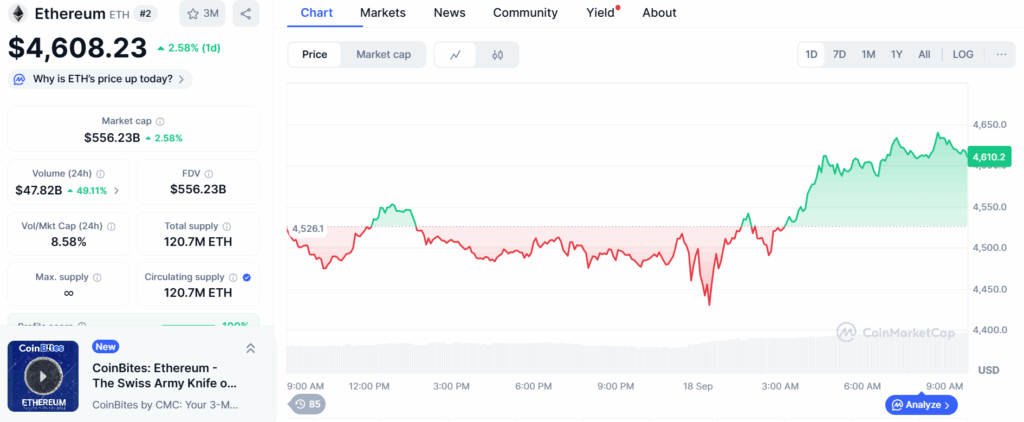

ETH price marked a larger jump of 2.58% in a single day, taking the value to $4,608.23. It goes on to reflect that the ETH price soared by 4.45% in the last 7 days amid an uptick of 49.11% in 24-hour trading volume.

An estimate, based on ETH price prediction, underlines that ETH is likely to breach the mark of $5,000 in the next 30 days. If achieved, then it could set the roadmap for the high of over $7,000 in the next 3 months from this point.

Impact on Spot BTC ETF and Spot Ether ETF

A rate cut of 25 bps by the US Federal Reserve is anticipated to boost inflows into Spot Bitcoin ETF and Spot Ether ETF. Spot BTC ETF noted an outflow of $51.3 million, and Spot Ether ETF recorded an outflow worth $1.9 million on September 17, 2025.

With a rate cut announced by the Fed, investors are likely to divert a larger share of their portfolio to risky investments. This pertains to cryptocurrencies and crypto ETFs, in this context. The cumulative total inflow for Spot BTC ETF stands at $57,293 million, and $13,678 million for Spot Ether ETF.

It is important to note that all values are true at the time of writing this article. The contents of the article are neither recommendations nor advice for crypto trading and investment.

Highlighted Crypto News Today:

Trump sues New York Times for $15B, says reporting hurt $TRUMP token