- Trump’s potential presidency boosts crypto optimism and BTC prices near $69K.

- Upcoming NFP report critical for interest rate expectations and market movements.

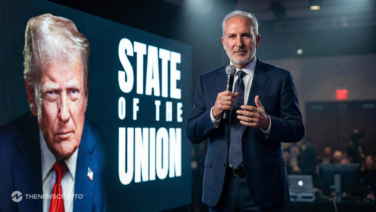

With just two weeks until the US elections, market sentiments are shifting as former President Donald Trump extends his lead over Vice President Kamala Harris in betting markets. As key swing states begin to lean Republican, traders are increasingly pricing in a potential Trump presidency, which has historically been viewed as more favorable towards cryptocurrencies.

This political backdrop has contributed to a notable uptick in Bitcoin (BTC) prices, which are edging closer to $69,000. The increased enthusiasm for BTC can be attributed to a record high in open interest across cryptocurrency exchanges, currently sitting at $40.5 billion. The anticipation surrounding the elections, combined with Trump’s more crypto-friendly stance, has spurred positive momentum in the digital asset market, reports QCP.

Meanwhile, in parallel, the US dollar has strengthened amid discussions of increased tariffs. And tax cuts, contributing to rising US bond yields. The S&P 500 index continues to climb toward all-time highs, while the yield on US 2-Year Treasuries has surpassed 4%. Such economic indicators are fostering a sense of optimism regarding sustained growth in the US economy.

The upcoming Non-Farm Payroll (NFP) report, set for release next Friday. It is anticipated to play a critical role in shaping market expectations. As the last NFP report before the next Federal Reserve meeting, its findings will likely influence decisions regarding interest rates. Currently, the market is pricing in approximately 1.5 rate cuts for 2024. A robust labor market and growing confidence drive economic resilience.

Intricate Relationship Between Politics And Crypto

In light of this bullish environment, traders are exploring investment strategies designed to capitalize on potential price gains while mitigating risks. One such strategy is the “Principal Protected Sharkfin” for BTC and Ethereum (ETH). This investment plan allows for upside potential if prices rise, offering protection against downside risks. The strategy specifies a maturity date of December 27, 2024, with a strike price of $80,000 and a barrier set at $90,000. It presents a maximum payout of 64.26% annually.

As the political landscape evolves and key economic data looms, all eyes remain on the cryptocurrency market.

Highlighted News Of The Day