- The UK Tax Authority is currently working on significant changes to how they tax DeFi lending and staking.

- There have been rumblings in the UK about introducing new tax restrictions related to DeFi lending and staking.

- Potentially significant consequences for the UK DeFi market may result from the proposed revisions.

The UK Tax Authority is considering making substantial changes to the regulation of DeFi lending and staking, which may have far-reaching consequences for the future of crypto taxes. This recent move is an indication that the government of the United Kingdom is striving to guarantee that crypto-related activities are taxed in a fair and equitable manner. It has been working to do for the crypto sector more generally.

As the cryptocurrency market develops and grows, innovative practices like DeFi lending and staking have gained traction. Moreover, these actions entail receiving interest on Bitcoin assets or providing liquidity to decentralized finance systems. There is currently no clear advice or laws regarding the tax status of these activities in the United Kingdom.

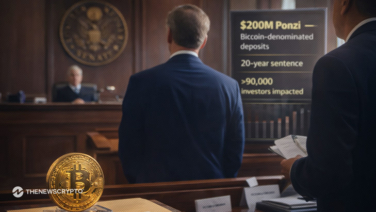

Possible Pros and Cons of New UK Crypto Tax Law

The suggested changes may result in new tax restrictions for DeFi lending and staking in the United Kingdom. Having a clear understanding of their tax obligations would be a huge relief for people and enterprises partaking in these activities. Additionally, this might imply that people in the UK are taxed more for engaging in these activities. This would probably dampen interest in the DeFi sector.

The nature of the new laws and regulations will determine the effect of the proposed modifications on the future of crypto taxes. The United Kingdom (UK) may adopt a more progressive stance on crypto taxes by establishing a system. Furthermore, this system would strike a reasonable balance between the two competing goals of generating tax revenue and encouraging growth.

The government might also adopt a more cautious approach and try to discourage crypto usage by placing heavy taxes on crypto-related activity. The DeFi business may gain some credibility with regulators and more conventional banks if the suggested modifications are implemented. DeFi might see the more public appeal and adoption if lending and staking are taxed similarly to other conventional forms of finance.

The UK Tax Authority’s planned big modifications to the regulation of DeFi lending and staking. Hence, this huge step forwards in the taxation of cryptocurrencies for the long run. However, they have the potential to legitimate the DeFi sector and give much-needed clarification to those participating in these activities. The new laws and regulations might have a significant effect on the UK crypto business.

Recommended For You: