- The official warning also notes that the market is very speculative and unpredictable.

- The warning comes as the SEC’s two-year legal struggle with Ripple nears its conclusion.

The United States Securities and Exchange Commission (SEC) has issued a warning to investors about cryptocurrency investments. The agency has specifically mentioned digital assets that may not conform to several US rules and has urged investors to think twice before becoming involved.

This development comes after a slew of regulatory lawsuits against Tron founder Justin Sun and his celebrity backers. The official warning also notes that the market is very speculative and unpredictable. It also details the most recent regulatory crackdown on the sector as a whole.

After recent enforcement actions taken against numerous firms, the SEC has issued an investor notice warning of potential risks associated with cryptocurrency investments. To be more specific, the regulatory body has issued a press statement warning new investors of the risks involved in the sector.

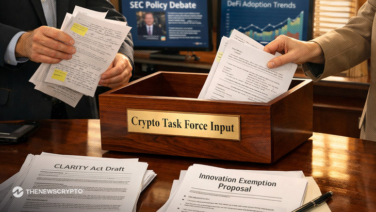

Regulation by Enforcement Approach

Cryptocurrency investments may be very volatile and speculative, the warning states. There is also a warning about the “risk of loss” for private investors as well. It also stated, “the only money you should put at risk with any speculative investment is money you can afford to lose entirely.”

In addition, the SEC warned that certain cryptocurrency investment firms “may not be complying with applicable law, including federal securities laws.” After that, they mention the possibility of scammers, who are experts at convincing retail investors into schemes, frequently resulting in terrible losses.

On the other hand, the warning comes as the SEC’s two-year legal struggle with Ripple nears its conclusion. But, the regulator’s recent enforcement actions indicate a fresh emphasis on taking a hard line against certain digital asset organizations.