- Trump’s family reportedly earned nearly $100M from TRUMP token trading fees.

- The U.S. imposed a 25% tariff on aluminium and steel, impacting global markets.

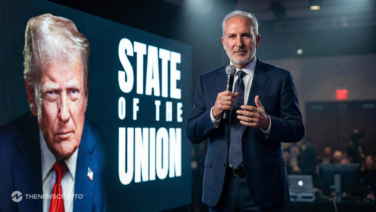

Trump’s pro-crypto stance is reshaping the industry. Reports suggest the Trump family and associates earned nearly $100 million from $TRUMP token trading fees. His victory over Kamala Harris was a pivotal moment for crypto enthusiasts. Many expected his administration to push crypto-friendly policies. While some policies have supported the sector, recent tariff decisions have introduced unexpected challenges.

Trump’s Tariff Policy and Market Reaction

On February 9, the Trump administration imposed a 25% tariff on aluminium and steel. This move sent ripples through global markets. Canada, Brazil, Mexico, South Korea, Russia, and Japan are among the largest steel exporters to the U.S. Meanwhile, top steel importers from the U.S. include Canada, Mexico, China, and Italy. The new tariffs have raised concerns about economic strain and market volatility.

Crypto markets reacted immediately. Yesterday, the total market cap fell by 0.32%. However, a 0.64% rebound today suggests resilience. The Crypto Fear and Greed Index dropped from 46 to 43, showing weak investor confidence despite recovery signals.

TRUMP Token’s Market Decline

TRUMP token plunged 10.24% in the last 24 hours, settling at $15.52. The market cap dropped 9.45% to $3.17 billion. However, trading volume surged 47.84% to $1.57 billion, reflecting increased activity. The token’s fully diluted valuation (FDV) now stands at $15.88 billion, with a circulating supply of 199.99 million TRUMP.

TRUMP faces resistance at $18.05 and support at $14. A breakout above the resistance could push it toward $20. However, a drop below support may send it to $12. The Relative Strength Index (RSI) at 37.93 signals oversold conditions. With an RSI average of 39.82, momentum remains weak, but a rebound is possible if buying pressure strengthens.

A bearish moving average (MA) crossover reinforces the downward trend. The 9-day MA at $16.57 is below the 21-day MA at $16.88, signaling further downside unless reversed. The Chaikin Money Flow (CMF) indicator shows weak capital inflow. If volume continues rising without price recovery, further volatility may follow. TRUMP token needs to reclaim $16.88 for bullish momentum. If resistance holds, further losses could follow.

Highlighted Crypto News Today

WazirX Releases Preliminary Creditor List and Balance Snapshot