- Trump criticizes Powell’s refusal to support Fed rate cuts, calling his decisions damaging.

- Potential replacements favor a more aggressive approach to cutting interest rates.

- Debate over Fed rate cuts intensifies as political pressure mounts ahead of 2026.

The controversy over U.S. monetary policy has intensified with the Presidency of Donald Trump. He is confirming that he will shortlist three to four likely candidates to replace Jerome Powell as Federal Reserve Chair by the time Powell’s current term expires in May 2026.

During a recent media outing at the NATO summit in The Hague, Trump again berated Powell for criticizing his leadership and style of managing interest rates. “He’s a very stu*id person,” Trump characterized, dubbing Powell’s economic policies “terrible” and “mentally average.”

Trump warned that Powell’s reluctance to cut interest rates could cost the U.S. economy billions in the long run. “We’ll be paying for him for years.” He added, estimating that a 2–3% increase in borrowing costs could lead to $900 billion annually in debt payments.

His frustration stems from what he views as Powell’s overly cautious approach to monetary easing, especially during periods of financial strain.

Who Could Replace Powell?

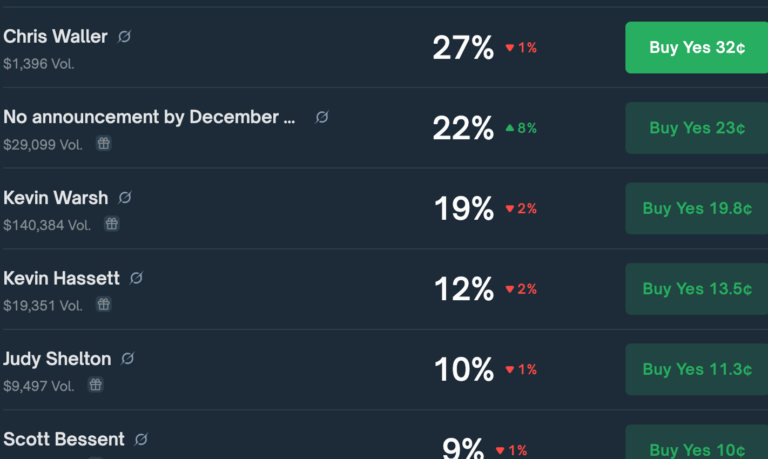

Potential replacements, according to prediction market info through Polymarket. Which are former Federal Reserve Governor Kevin Warsh, National Economic Council Director Kevin Hassett, and current Fed Governor Christopher Waller. All three have been known to hold pro-growth stances and might be a more suitable choice for Trump’s economic vision of sharp rate cuts.

Undeterred by political pressure, Powell has held firm, fact-based in his management of interest rates. In recent congressional testimony, he was compelled to acknowledge that tariffs would increase inflation. However, it emphasized that the data on hand is not yet conducive to significant rate cuts.

The Fed, he added, will continue to monitor the situation and cut rates only if inflation recedes or the labor market decelerates.

Powell is the opposite of Trump, who regards Fed restraint as economically damaging. The ex-president has been so vocal in his criticism that he questioned. Whether Powell’s motives are “more political than economic” and charged him with intentionally fighting rate cuts.

Market Views: Lutnick Weighs In

Cantor Fitzgerald CEO Howard Lutnick entered the fray, touting the economic advantages of tariff revenue. Lutnick argued that the U.S. is bringing in more than $30 billion per month with tariffs. The funds which could be used to help lower the federal deficit as well as reduce interest payments.

Lutnick further noted that reducing interest rates by 1% would result in a saving of hundreds of billions of dollars annually for the government. His argument aligns with Trump’s belief that cheaper borrowing costs would help ease the federal deficit and stimulate the economy.

Conclusion

As the political and economic environment continues to shift. The question of direction for the Federal Reserve is going to be a recurring one heading into the 2025–2026 cycle. With Trump weighing over a change at the Fed’s helm, the future of U.S. The monetary policy will be turned on its head, particularly if his nominee takes a more aggressive stance on reducing interest rates.

Highlighted Crypto News Today

Pi Network Community May Be Overreacting to Chainlink-Mastercard Announcement: Here’s Why