As crypto markets rebound in 2025, all eyes are turning to real-world DeFi applications — and JamFi is emerging as one of the top presales to watch.

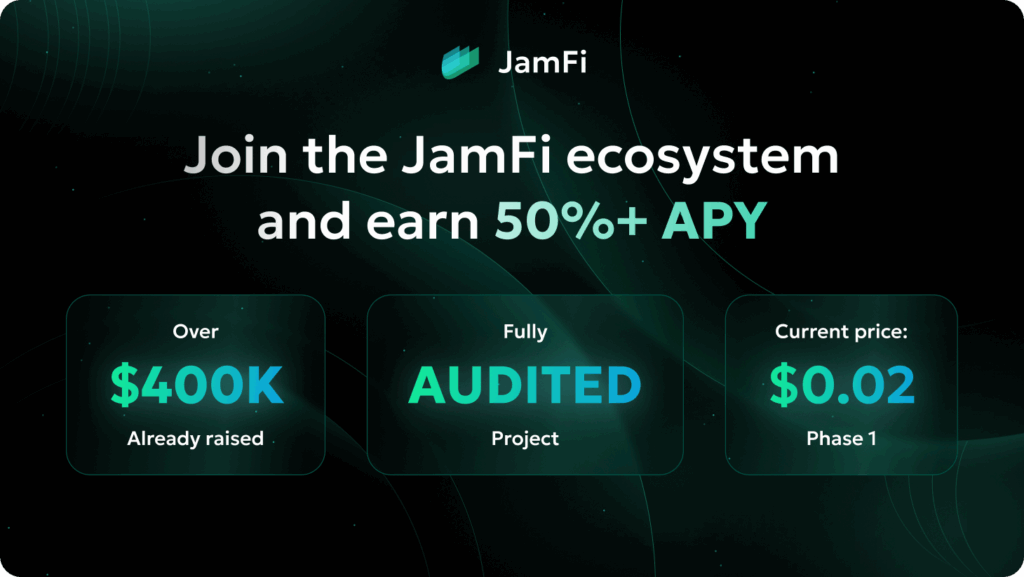

This decentralized lending platform is quietly reshaping how millions in Africa access credit. And with a fully audited ecosystem, rising presale momentum, and real-world integrations like M-Pesa, JamFi is quickly gaining traction with early investors and institutions alike.

What Makes JamFi a Special Project in 2025

Built on Ethereum and powered by the $JAMI token, JamFi aims to solve one of the most overlooked problems in global finance: the lack of accessible credit in underserved regions.

With over 50 million M-Pesa users in Kenya alone, JamFi’s integration into the mobile-first economy positions it at the center of a financial revolution.

The project raised $400,000 in seed funding and is now in an early presale stage at $0.02 per token — with prices expected to rise to $0.08 in later rounds and debut on Uniswap at $0.10 in early 2026.

According to McKinsey, Africa’s financial services market is projected to hit $230 billion by 2025 — and JamFi is strategically aligned to capture a significant slice of this emerging sector.

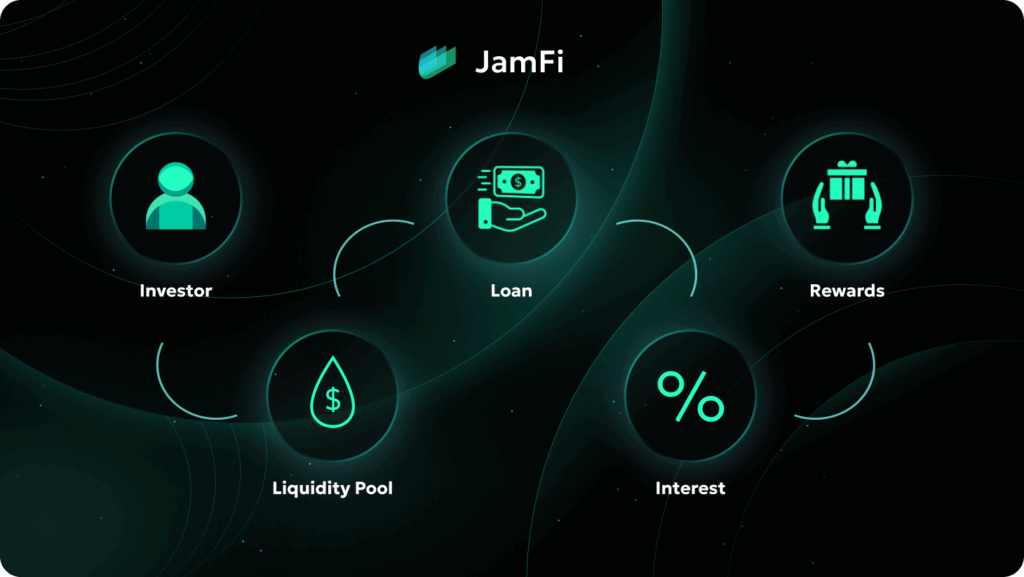

JamFi Offers Two Paths to Decentralized Lending

What makes JamFi unique is its dual approach to lending:

- Traditional collateral-based loans through licensed physical offices.

- DeFi loans with crypto collateral and minimal verification through a sleek mobile interface.

This hybrid model allows someone in Nairobi or Lagos to take a loan using ETH or USDT as collateral and repay it directly via M-Pesa, streamlining the entire process through smart contracts for transparency and speed.

For investors, JamFi offers DeFi-native returns through staking and liquidity pools, where users can lock assets like USDC or ETH and earn yield from borrower repayments. Early stakers also qualify for bonus airdrops if tokens are staked within the first month post-unlock.

Tokenomics and Presale Mechanics Support Long-Term Growth

The total supply of $JAMI is capped at 1 billion tokens, with a distribution designed for long-term sustainability:

- 40% for liquidity and lending pools

- 20% for early investors (vested over 1 year)

- 15% for the team

- 10% for marketing

- 10% for the treasury

- 5% for airdrops

A buyback-and-burn mechanism further supports price stability by using platform fees to purchase and burn $JAMI tokens from the open market.

This makes the tokenomics more resilient than those of most early-stage DeFi projects, and significantly reduces the risk of heavy post-launch dumps.

Security and Regulation Set JamFi Apart

Security is front and center at JamFi. Loans on the platform are overcollateralized at 130%, and borrowers are notified if their collateral value drops, with a 48-hour window to top up before liquidation.

Smart contracts are audited by Smart Dec, and the team is actively collaborating with the Central Bank of Kenya and South Africa’s FSCA to secure licenses for crypto-financial operations.

If borrowers default, assets are liquidated via OTC or exchange mechanisms, protecting lenders and maintaining platform solvency.

JamFi’s Roadmap:

Key Milestones Ahead:

- Q2 2025 – Q1 2026: Token presale, MVP testing, M-Pesa integration, and staking launch.

- Q2 – Q3 2026: Listing on Uniswap, mobile app release, WapiPay integration, and community DAO planning.

- Q4 2026: Launch of advanced DeFi features and entry into EU/LatAm markets.

- Q1 2027: Centralized exchange listings and B2B lending solutions for local businesses.

Real-World Utility for JamFi

While many tokens rely solely on hype, JamFi’s $JAMI token is already being positioned for real-world use.

Users across Kenya and neighboring regions will be able to use $JAMI for purchases ranging from agriculture equipment to education services via integrated marketplaces.

This utility is already driving organic demand. A student in South Africa might use $JAMI to pay for online courses, while a farmer in Uganda could access affordable capital for tools — all without traditional banking barriers.

Conclusion: JamFi Could Be 2025’s Breakout Presale

With strong fundamentals, a mission that blends DeFi with real-world value, and a clear roadmap, JamFi stands out as one of the most promising ICOs of the year.

Its seed round was oversubscribed with $400,000, now the presale is gaining momentum at $0.02 per $JAMI, and partnerships with platforms like M-Pesa and WapiPay are already positioning it as a key player in African crypto adoption.

If you’re looking for an early-stage project with long-term upside, JamFi should be on your radar.

👉 Join the presale at jamii.finance and follow the updates:

- X:https://x.com/JamiiFinance

- Telegram:https://t.me/jamiifinance

- Medium:https://medium.com/@JamiiFinance

Disclaimer: TheNewsCrypto does not endorse any content on this page. The content depicted in this Press Release does not represent any investment advice. TheNewsCrypto recommends our readers to make decisions based on their own research. TheNewsCrypto is not accountable for any damage or loss related to content, products, or services stated in this Press Release.