- The CFTC’s approval shifts Bitcoin ETF options to OCC increased market liquidity.

- CFTC’s approval, Bitcoin’s price increased to $91,000.

The United States Commodity Futures Trading Commission (CFTC) has taken a big step toward introducing spot Bitcoin exchange-traded fund (ETF) options. This decision removes a key regulatory barrier, with analysts predicting that these products could soon be available to investors.

CFTC’s Announcement

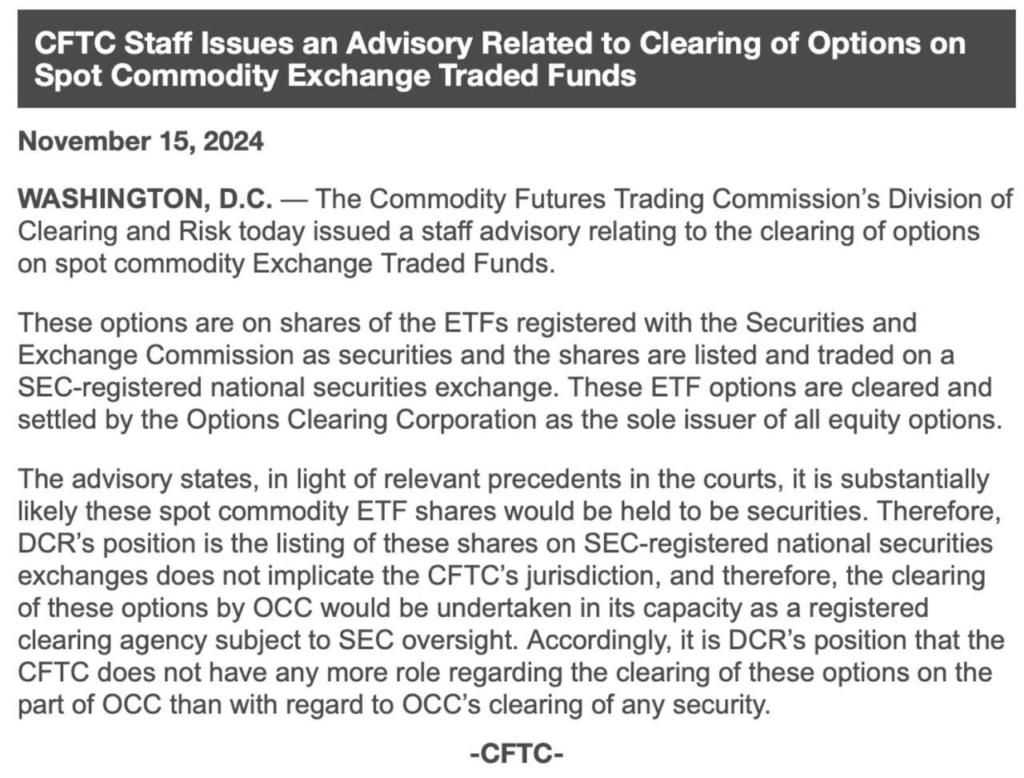

On November 15, the CFTC announced that its Division of Clearing and Risk (DCR) would no longer be involved in clearing Bitcoin ETF options. Instead, the Options Clearing Corporation (OCC), which oversees all equity options, will handle these products. This move shifts the responsibility to the OCC, putting Bitcoin ETF options one step closer to being listed.

ETF analyst Eric Balchunas noted, “The ball is now in OCC’s court, and they’ll probably list very soon.” Another analyst, James Seyffart, expressed similar enthusiasm, saying, “Here. We. Go.”

The Securities and Exchange Commission (SEC) already approved Bitcoin ETF options earlier this year for the New York Stock Exchange (NYSE) and the Chicago Board Options Exchange (CBOE). With both SEC and CFTC hurdles cleared, the OCC is the final authority before these options hit the market.

Jeff Park, an expert from Bitwise Invest, stated, “Bitcoin ETF options are closer than you think,” while remaining cautious about an exact launch date. He expects the process to move quickly, though a 2024 launch isn’t guaranteed.

CFTC Impacts the Crypto Market

The introduction of Bitcoin ETF options could bring major changes to the crypto world. These options allow traders and institutions to manage risks and make advanced bets on Bitcoin’s price. Analysts believe this will increase market liquidity and attract more large investors.

Nick Forster, founder of Derive, highlighted the potential impact, saying these options could cause significant price movements in Bitcoin due to its limited supply. Meanwhile, Bitcoin enthusiast Michael Saylor sees this development as a way to increase institutional adoption and strengthen Bitcoin’s reputation as a serious financial asset.

Bitcoin’s Price Reaction

The news of the CFTC’s decision increased Bitcoin’s price, which crossed $91,000. Although it briefly dipped to $87,100 after Federal Reserve Chair Jerome Powell’s comments on interest rates, Bitcoin quickly bounced back, reflecting strong market confidence.

Bitcoin ETF options represent a big step toward integrating cryptocurrencies into traditional finance. They offer investors new tools for managing risks and could attract billions of dollars in new investments. The approval also adds credibility to Bitcoin, showing it’s becoming a more accepted part of the financial system as many institutional investors are adopting.

As the CFTC’s approval of Bitcoin ETF options is a major milestone for the crypto industry. With the OCC expected to finalize the process soon, these options could be available in the near future, making it easier for institutions and investors to engage with Bitcoin.