- Texas House passes Bitcoin reserve bill with bipartisan support.

- Only cryptos with a $500B market cap over 24 months will qualify.

- Texas may soon follow New Hampshire with a state-run BTC reserve.

In a landmark move for state-level cryptocurrency adoption, the Texas House of Representatives on Tuesday advanced Senate Bill 21, aimed at establishing a state-managed Bitcoin reserve. The bill passed its second reading with a strong 105-23 vote, gaining bipartisan backing and edging closer to becoming law.

The proposed legislation Texas Strategic Bitcoin Reserve and Investment Act, would allow the state to hold and manage Bitcoin as a financial hedge. Under the bill, the reserve would be managed by the state comptroller and would be a special fund that would exist apart from the state treasury.

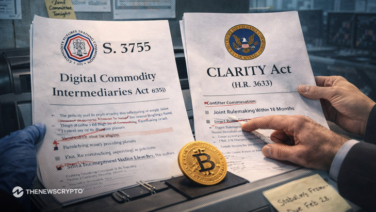

Amendment Constricts Crypto Eligibility

During the session in the House, there was a major development when Rep. Linda Garcia (D-TX) introduced an amendment. The amendment doubles the required market capitalization period for eligible cryptocurrencies from 12 to 24 months. That means only assets with a market cap of $500 billion maintained over two years would qualify for inclusion in the reserve.

The purpose is to allow only established, stable cryptocurrencies, notably Bitcoin, into the fund, reducing volatility and risk.

State Rep. Giovanni Capriglione (R-Texas), who introduced the bill in the House, called it a “forward-thinking measure” and a way to bolster Texas’s financial resiliency. He added that digital assets should be seen not just as trends but as long-term tools for economic strategy.

Texas Could Join New Hampshire in Bitcoin Reserve Push

Should the legislation pass its third reading and be reconciled with any changes in the Senate, Texas would become the second U.S. state, after New Hampshire, to manage its own government-controlled Bitcoin reserve.

The legislation was initially filed in December as H.B. 1598, capturing the state of Texas’s increasing participation in the digital asset economy. In the last two years, Texas has emerged as a leader among states for crypto mining, and thus this bill is a natural fit for its crypto-leaning policies.

The planned reserve is intended to be an inflation and economic volatility hedge, and the legislation would compel the state comptroller to report every two years about its crypto assets, their value, and how they performed. In addition, a committee of crypto investment professionals would guide the comptroller in how to invest the reserve prudently.

While the bill still requires a third reading in the House, it is widely expected to pass due to strong bipartisan support. However, because of the amendment adopted in the House, any differences with the Senate version must be resolved before the bill can be sent to the governor’s desk for signing.

Arizona had similar ambitions earlier this year but fell short when its governor vetoed the measure. Texas now has a unique opportunity to shape the future of state-level crypto adoption in the U.S.

Highlighted Crypto News Today:

UNI Price Navigates Resistance Levels at $8.30 with Solid Upside Potential