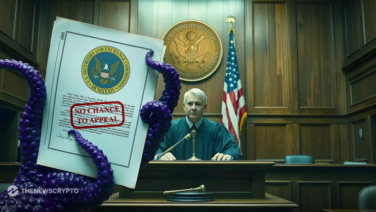

What’s Behind XRP’s 30% Surge to a 3.6-Year High?

XRP has surged to its highest level in 3.6 years, crossing $1.43, following SEC Chair Gary Gensler’s confirmation that he will step down in January 2025. The news sent XRP’s price soaring over 32% in just 24 hours, climbing from $1.10 to an intraday peak of $1.43—a level not seen