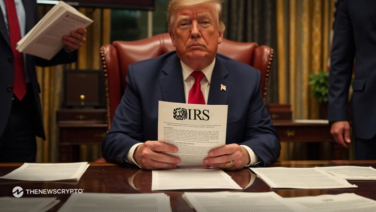

U.S. Urges Supreme Court to Reject Coinbase User’s IRS Privacy Claim

The government of the United States has requested that the Supreme Court accept the Coinbase users’ challenge against the Internal Revenue Service’s effort to obtain their crypto transaction records. On May 30, Solicitor General D. John Sauer claimed in his filing that the user of Coinbase, James Harper, has no