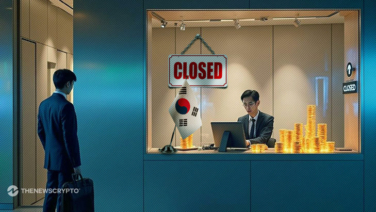

South Korea to Enforce Strict KYC Rules for Crypto Sales in June

The Financial Services Commission of South Korea will make it compulsory for non-profit organizations and crypto exchanges to comply with a firm customer verification process from June. The official release of FSC states that these bodies will be permitted to sell virtual assets under new laws. Nonprofits are permitted to