Crypto Market Highlights in May 2024 Recounted

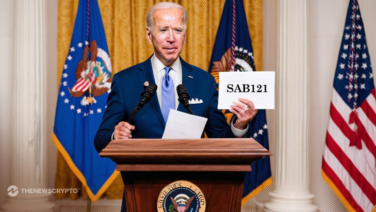

The overall crypto market witnessed key moments in May 2024. While the market witnessed price hikes, the SAB 101’s veto caused obstacles. Cryptocurrency has also played a crucial role within the US political landscape which fueled further events. Besides, with multiple crypto crimes and significant arrests the month has been