Fed Chair Powell Advocates for Stablecoin Legislation Via Collaborative Efforts

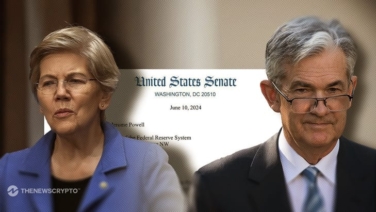

The latest congressional testimony by Federal Reserve Chair Jerome Powell revealed strong desire to have stablecoin legislation passed before the year closes. Recently, Fed Chair Jerome Powell voiced his support for stablecoin regulation. Rep. Wiley Nickel asked Powell about the Federal Reserve’s stance on stablecoin regulation. And Powell said that