- SUI is trading at $1 after dropping by 10%.

- Daily trading volume has surged by over 67%.

With a steady loss of over 6%, the crypto market is getting trapped tough in the bearish hold. The red paint is splashed all over, and that triggers the digital assets to slip down to their former support zones. Following suit, Bitcoin has plunged by over 5% and Ethereum with a 9% drop. Meanwhile, SUI has registered a notable decline in value of over 10.32% in the last 24 hours.

With a sturdy reversal in the active trend, will the asset’s price see a steady upside? SUI opened the day trading at around $2.04, and the bearish encounter has pushed it down to a low of $1.80. If the asset continues to move downward, the price may lose further momentum and fall deeper for a correction.

At the time of writing, SUI trades at $1.81, with its market cap at $6.63 billion. Besides, the daily trading volume has surged by over 67.05%, reaching the $1.36 billion mark. The Coinglass data has reported that the market has witnessed a 24-hour liquidation of $5.51 million worth of SUI.

Can the SUI Bulls Step In Before the Downtrend Worsens?

With the ongoing downtrend, SUI bears might drive the price to new lows. It could fall and test the crucial support range at around $1.70. The strengthened bearish correction may extend the losses, triggering the death cross to unfold, and eventually send the price to its former low of $1.59.

However, if the active momentum weakens and an uptrend emerges, the SUI price could immediately climb toward the $1.92 resistance. Assuming the bullish pressure gains more traction, it might initiate the golden cross to take place and drive the price to $2.03, acting as a key range for the asset.

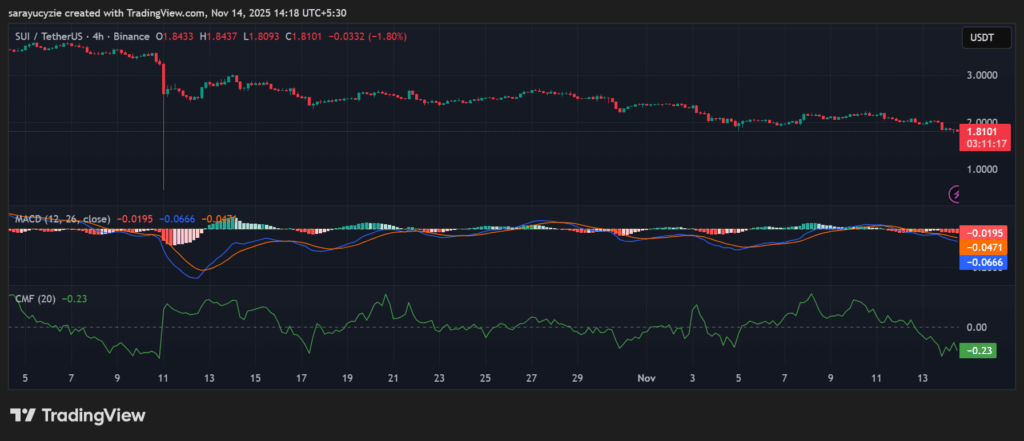

As SUI’s Moving Average Convergence Divergence (MACD) line and signal line have crossed below the zero line, the crossover generally implies a bearish phase. The overall trend is weak, and the recovery might take longer unless both the lines climb back above zero.

Additionally, the Chaikin Money Flow (CMF) value resting at -0.23 points out that the sellers are currently dominating the SUI market. It shows capital outflows-money is moving out of the asset. Notably, this level bears bearish pressure, with weak buying strength.

The daily Relative Strength Index (RSI) found at 30.63 is placing SUI in the oversold condition. It indicates strong bearish momentum and hints at a potential reversal if buyers step in. Moreover, SUI’s Bull Bear Power (BBP) reading of -0.2006 suggests that bears have control over the market. With the negative value, the price is trading below, and the momentum may continue unless a shift occurs.

Top Updated Crypto News

Red Bed for Solana (SOL) After a 10% Slide: Will Bulls Rescue the Price Before it Slips Deeper?