- Bitcoin surged to $64,058 in just 10 hours, a 12% increase from $57,213.

- Crypto exchange Coinbase crashes due to technical issues after BTC touches $64K.

The crypto market titan Bitcoin (BTC) has entered a bullish streak, achieving a significant breakthrough by exceeding the $64,000 zone for the first time since November 2021.

BTC’s rally continued as it peaked at a new yearly high of $64,058 on February 28, marking a 12% price surge in just 10 hours, rising from $57,213. This month alone, Bitcoin has seen an astonishing 50% increase, largely fueled by investor interest in spot ETFs.

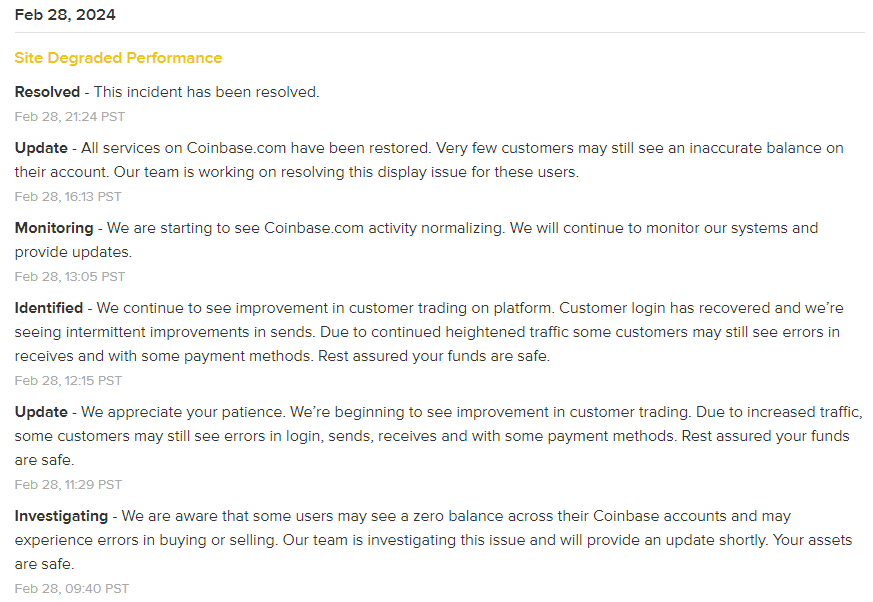

Following the BTC pump, one of the largest crypto exchanges, Coinbase, appears to have crashed, prompting user notifications and acknowledgment of the issue. The exchange’s status page indicates an ongoing investigation, with some users possibly experiencing zero balance in their accounts.

Why is Bitcoin (BTC) Soaring?

Bitcoin is experiencing an uptick driven by several factors, including heightened interest in Bitcoin ETFs and anticipation surrounding the upcoming halving event, expected to occur on April 22, garnering increased attention within the crypto community.

The total Spot Bitcoin ETF trading volume exceeded $7.5 billion for the third consecutive day. BlackRock’s Bitcoin ETF saw trading activity reach $3.3 billion, doubling its previous volume record.

Additionally, global asset management giant Morgan Stanley announced that it is reportedly considering offering Spot Bitcoin ETFs to its brokerage platform, signaling increasing institutional interest in cryptocurrency.

However, amidst the excitement, Bitcoin experienced a sudden price correction, plummeting to $59,7898 shortly after reaching its peak. Analysts attribute this correction to selling pressure at the $64,000 level and the liquidation of leveraged long positions. Nevertheless, Bitcoin has shown resilience and recovered nearly 5% of the lost ground.

At the time of writing, BTC is trading at $63,193 with a market cap of $1.22 trillion. The cryptocurrency’s surge is underscored by its 22% price rally in the last week and a staggering 170% surge over the past year. Additionally, BTC’s daily trading volume has skyrocketed by over 124% to $90 billion, reflecting heightened market activity.

With Bitcoin now only 10% below its all-time high of $68,789, investors are optimistic about the possibility of setting a new record in the coming days. However, if the current trend reverses, Bitcoin may find support levels at $61,116, followed by potential declines to $59,250 and $58,700, with the risk of entering a bear trap looming.