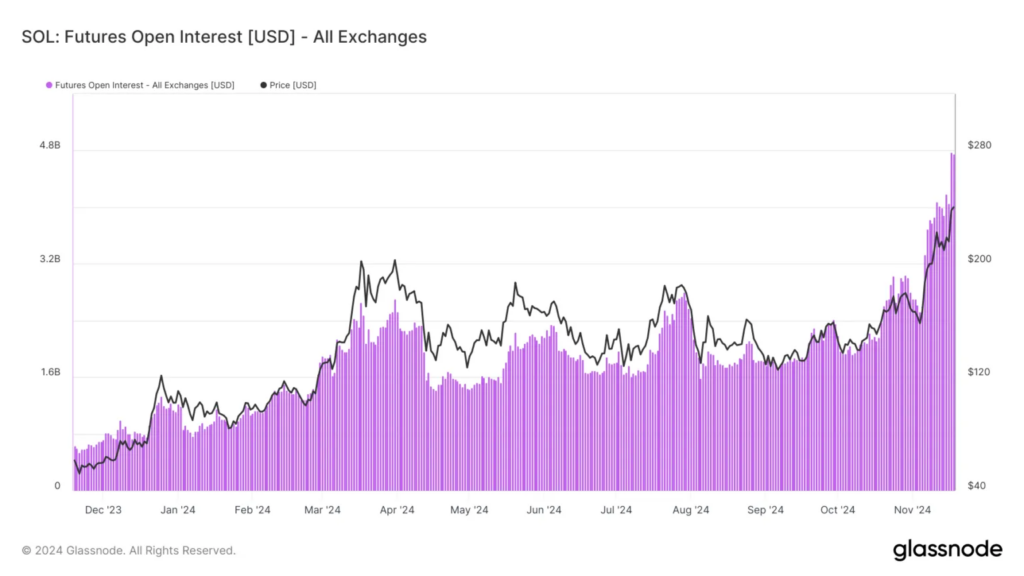

- Solana futures open interest hits record $4.7 billion

- Technical indicators show overbought conditions

- Price faces crucial resistance at $245 before potential ATH

Solana’s (SOL) remarkable price rally has brought it within striking distance of its all-time high, though the cryptocurrency faces significant technical hurdles. As traders pile into SOL positions, market indicators present a mixed outlook for the leading altcoin.

Solana Hits Record-Breaking Market Interest

Futures Open Interest for Solana has surged to an unprecedented $4.7 billion, signaling massive trader participation in the ongoing rally. This milestone demonstrates growing market confidence, even as the asset confronts key resistance levels.

“The surge in open interest approaching $5 billion reflects heightened trader optimism,” market analysts noted. “However, the divergence between price action and market positioning raises important considerations.”

The Relative Strength Index (RSI) has entered overbought territory, historically a precursor to price corrections. This technical signal, combined with the substantial open interest, suggests potential near-term volatility.

SOL currently trades just below the crucial $245 resistance level, the final barrier before a potential new all-time high above $260. A successful breach could trigger further upside, while failure might lead to a retest of $221 support.

“The $245 level represents a critical juncture for Solana’s immediate future,” technical analysts observed. “Converting this resistance to support could pave the way for new historic highs.”

Despite overbought conditions, Solana’s macro momentum remains strong, supported by increasing adoption and positive market sentiment. Traders are closely monitoring whether SOL can maintain its upward trajectory or if a cooling period is necessary before continuing its ascent.