- Solana rebounds 9% as spot market inflows return

- Open Interest surges 11% to $7.25B

- RSI at 67.49 indicates strong momentum without overbought conditions

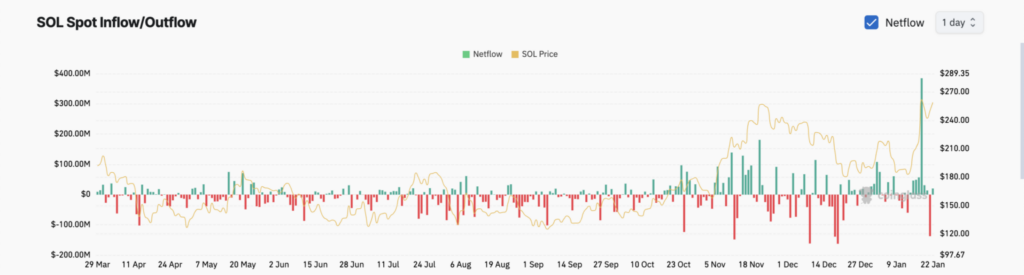

After experiencing a 14% decline from its all-time high of $295.83, Solana enters what appears to be a new accumulation phase. This shift becomes particularly significant when we consider the reversal from yesterday’s substantial $137 million outflow, suggesting that market participants are transitioning from profit-taking to position building.

Understanding Solana Flow of Capital

The return of positive net inflows to Solana’s spot markets represents more than just a daily fluctuation – it signals a fundamental shift in market psychology. Think of market flows like a tide: yesterday’s $137 million outflow marked the peak of the distribution phase, while today’s inflows suggest the beginning of a new accumulation cycle.

This SOL pattern often precedes sustained price appreciation, particularly when accompanied by strengthening derivatives metrics.

The 11% surge in Open Interest to $7.25 billion provides technical validation of this shift in market sentiment. When Open Interest increases alongside price appreciation, it typically indicates that new capital is entering the market rather than just existing positions being adjusted. This combination of spot inflows and derivatives expansion creates a particularly robust foundation for potential price appreciation.

The technical picture adds another layer of confirmation through the RSI reading of 67.49. This level is particularly interesting because it indicates strong bullish momentum while maintaining a safe distance from overbought conditions (typically considered above 70). This technical positioning suggests room for continued appreciation before significant resistance is encountered.

Looking forward, Solana’s ability to maintain these positive flows will likely determine whether price action can challenge the recent all-time high or retreat toward the $239.39 support level.

The confluence of positive spot flows, expanding derivatives interest, and favorable technical indicators suggests the path of least resistance may be upward, though careful monitoring of these metrics remains crucial for maintaining bullish market structure.