- Due to the heavy selling pressure, SOL is down 8.44% in the last 7 days.

- If the price goes below $20.4, then it will likely test $17.7 support level.

Solana co-founder Anatoly Yakovenko is citing an “obvious” use of cryptocurrencies and blockchain technology. Yakovenko cites straightforward payments as an example of an application of digital assets that may benefit everyone in a recent interview with Austin Federa, Head of strategy at the Solana Foundation.

Solana validator indicators such as node count, Nakamoto Coefficient, node spread and diversity continue to rise, as reported in the latest Solana Validator Health Report.

Solana has come a long way in a short amount of time as a multi-client network; now, over 31% of stake is processed through the Jito Labs client, up from 0% a year ago. There are currently two more validator clients in the works. Since a performance decline in February 2023, many new practices in software upgrading processes have been introduced, and the network has had 100% uptime ever since.

Further Decline Likely?

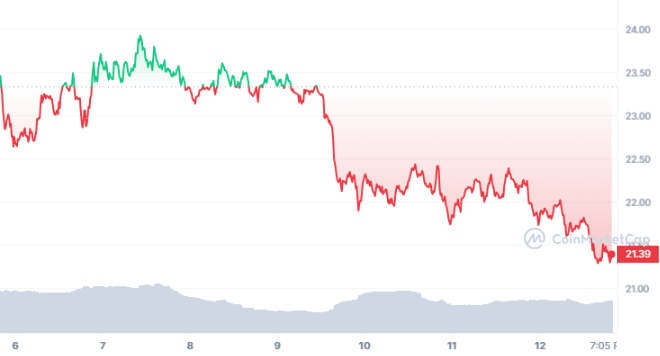

At the time of writing, SOL is trading at $21.39, down 3.77% in the last 24 hours as per data from CMC. Moreover, the trading volume is down $3.61%. Due to the heavy selling pressure, SOL is down 8.44% in the last 7 days. The price has been creating lower lows and lower highs, pointing towards further decline.

If the bears continue domination and take the price below $20.4, then it will likely test $17.7 support level. Further downfall will likely result in price testing $14.6 key support mark. However, if bulls drive the price above $22.4 resistance level, then price will likely go all the way till $23.9 resistance area.