- SOL fell nearly 47% from its January 19 high, reaching about $157.25 by February 24.

- Investor confidence is impacted by its link to the Lazarus Group, a pending $1.79B token unlock, and reduced futures market activity.

- A head-and-shoulders pattern and break below $177 support hint at a potential drop to around $110, though a rebound to $215 is possible if support holds.

Solana Price Performance

Solana Price is losing its gains following Donald Trump’s reelection. On February 24, SOL dropped 7.35% to around $157.25 its lowest since November 6. This is part of a bigger drop that began on January 19. When SOL hit an all-time high of $295.31, and it has since dropped by nearly 47%.

Several factors are bringing the price down for SOL. One of them is the recently reported association of Solana with the North Korean-backed Lazarus Group. Whose numerous hacks and memecoin scams have characterized the network. The association has dented investors’ confidence.

Another issue to worry about is the forthcoming token unlocking. On March 1, 11.16 million SOL tokens worth approximately $1.79 billion will be unlocked, mostly from the FTX estate. Investors worry that if these tokens come onto the market, they will contribute to the selling pressure and drive the price down.

Technical Analysis

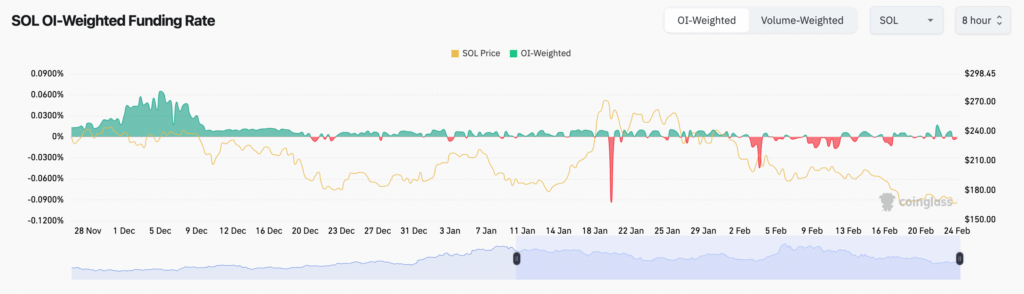

Moreover, market signals are also negative. The open interest in the futures market for SOL has declined from $8.57 billion on January 17 to $5.11 billion as of February 24, indicating that fewer investors are speculating on SOL appreciating in value. The weekly funding rates have also become negative, indicating that holders of long positions are being compensated by holders of short positions in SOL, which is a reflection of poor market sentiment.

The SOL technical chart indicates a head-and-shoulders pattern a characteristic bearish pattern. SOL broke below the support level of about $177 near the neckline. If this continues to be valid, the target would be around $110, down more than 30% from the levels at the time of writing.

However, if SOL manages to hold above the support level, there could be a bounce up to $215. This is exacerbated by waning interest in Solana-based memecoins like Official Trump, Bonk, and Dogwifhat. These memecoins account for much of the network usage, and waning activity means less demand for SOL, which is used as transaction fees.

Overall, the total of negative sentiment for hacks, impending token unlock. Low futures activity, and bearish technicals is substantially bearing down on the price of SOL. Traders are holding back in anticipation as the market awaits stronger signs of further downward action or a potential bounce.

Highlighted Crypto News Today

Berachain Overtakes Arbitrum, Base as TVL Surpasses $3.26 Billion