- Solana price drops 12% from ATH of $264.63

- Short positions surge to $6 billion, outpacing longs

- Critical support at 20-day EMA could determine next move

Solana (SOL) has encountered significant selling pressure following its recent ascent to an all-time high of $264.63 on November 24. Currently trading at $232.72, the cryptocurrency has experienced a 12% retracement, prompting a notable shift in market sentiment and trading behavior.

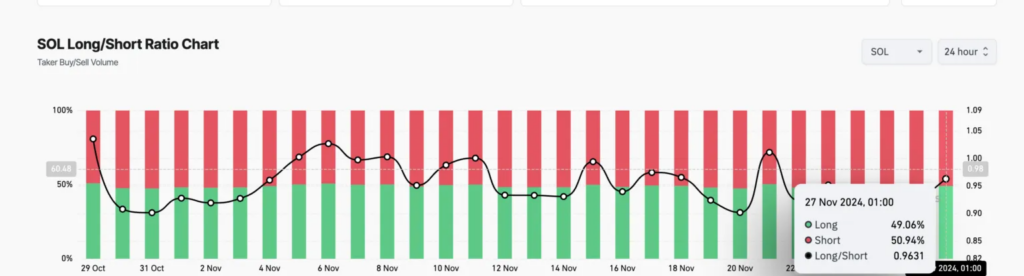

The derivatives market paints a particularly telling picture of current market sentiment. Data from Coinglass reveals that short positions have accumulated to a substantial $6 billion, significantly overshadowing long positions which stand at $5.38 billion.

Mounting Market Pressure Tests Solana’s Resilience

This imbalance is reflected in the long/short ratio of 0.96, indicating that traders are increasingly positioning themselves for further downside movement.

Social sentiment metrics further reinforce the bearish outlook, with the weighted sentiment indicator registering -0.40. This negative reading suggests that market discussions are dominated by cautious or pessimistic perspectives, typically associated with reduced trading activity as participants attempt to minimize potential losses during uncertain market conditions.

From a technical analysis standpoint, SOL faces a crucial test at its 20-day Exponential Moving Average (EMA), currently situated at $226.52. This indicator has served as reliable dynamic support since October 11, making its potential breach particularly significant.

A decisive move below this level could trigger accelerated selling pressure, potentially driving prices toward the $205.56 support zone.

However, the market remains dynamic, and a shift in sentiment could still propel SOL back toward its recent all-time high of $264.63. The coming days will be crucial in determining whether current bearish positioning proves prescient or premature.