- Solana network loses 500,000 new addresses in 10-day correction

- MVRV ratio nears 1.65 danger threshold

- Price reclaims $201 with 8% daily gain

Solana’s recent price action presents an interesting study in market psychology as the cryptocurrency rebounds from its dip below $170. The recovery to $202 marks a significant technical achievement, though the sustainability of this bounce depends on the delicate balance between new investor participation and profit-taking behavior.

Understanding Solana Network Health

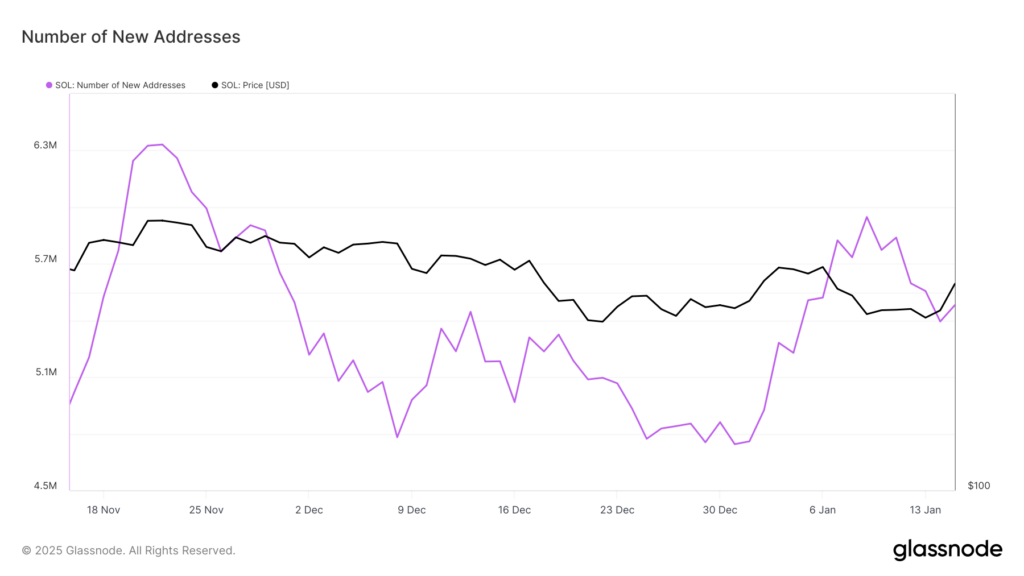

The loss of 500,000 new SOL addresses over ten days tells us something important about market sentiment during price corrections. This metric, which tracks unique addresses interacting with the network for the first time, serves as a crucial barometer of ecosystem growth and adoption.

Think of these new addresses as potential long-term participants – their absence during corrections often precedes periods of accumulation when prices stabilize.

The MVRV ratio adds another layer of complexity to this analysis, approaching the critical 1.65 threshold that has historically signaled profit-taking opportunities. This metric’s approach to the danger zone creates an interesting tension – while price recovery typically attracts new investors, the elevated MVRV suggests that short-term holders may soon look to secure profits.

Currently trading at $202, Solana faces immediate resistance at $221, a level that has contained price action for nearly a month. The resolution of this technical standoff likely depends on whether returning investor interest can offset potential profit-taking pressure.

A successful breach of $221 could open the path toward $245, while failure to maintain $201 support risks a decline toward $183.

The convergence of these factors – network participation, MVRV readings, and technical levels – creates a complex market environment that requires careful monitoring of both on-chain and price metrics to gauge the sustainability of the current recovery.