- SOL reaches $180, first time since July.

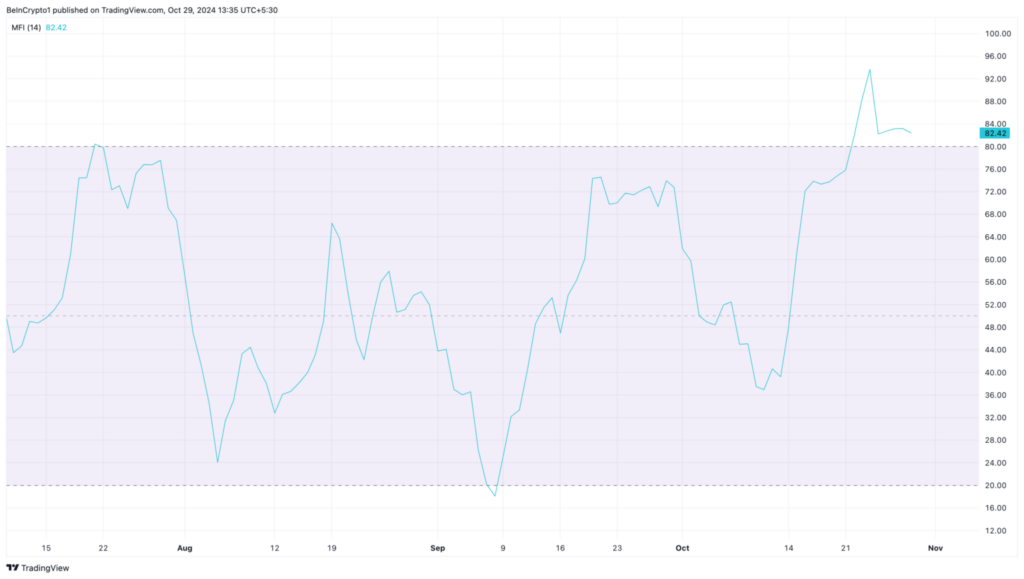

- Chaikin Money Flow at 0.28 and MFI above 80 suggest overbought conditions.

- Price targets: potential retreat to $161.81, or direct push to $200 if $185 breaks.

Solana (SOL) has achieved a major milestone, touching the $180 mark for the first time since July, sparking widespread speculation about its potential to reach $200.

While this surge demonstrates impressive momentum, technical indicators suggest the possibility of a consolidation phase before further advances.

The Chaikin Money Flow (CMF) indicator provides crucial insight into SOL’s current market dynamics. Reading 0.28, the CMF has entered overbought territory, surpassing the typical threshold of 0.20.

While this level confirms strong buying support for the recent price movement, it also signals potential exhaustion in buying pressure.

A price correction for Solana is impending

Complementing the CMF’s warning signals, the Money Flow Index (MFI) has exceeded 80.00, further confirming overbought conditions.

This technical setup traditionally suggests that a price correction or consolidation phase may be necessary before continuing upward momentum.

Daily chart analysis reveals Solana’s successful breakout from an ascending triangle pattern, with price action retesting the $180 level.

However, the $185 supply zone looms as a significant hurdle, having previously triggered a 30% correction. This historical resistance level could force a retracement to $161.81 before any sustained push toward $200.

Despite these cautionary signals, the possibility of a direct move to $200 remains if bulls can decisively breach the $185 resistance level. Such a scenario would require sustained buying pressure and likely coincide with broader market strength.