- Singapore Gulf Bank plans to raise $50 million by selling 10% equity to buy a stablecoin payments company in 2025.

- The funds will be used to develop new products, improve payments, and grow the team.

- The bank aims to lead digital finance by using stablecoins to connect traditional and crypto economies.

Singapore Gulf Bank’s $50 Million Fundraising Plan

Singapore Gulf Bank Seeks $50 Million to Expand with Stablecoin Acquisition. It’s a blockchain-focused digital bank. Which plans to raise $50 million in 2025 to acquire a stablecoin payments company.

This strategic move reflects the bank’s focus on expanding its services and strengthening. Its position in the growing digital finance market.

The bank, run by Singapore’s Whampoa Group and licensed in Bahrain. Which plans to sell up to 10% of its equity to raise the necessary funds to achieve this goal. More negotiations with investors, including a major Middle Eastern sovereign wealth fund. Which are ongoing to finalize the deal. As a result, the equity sale is expected to be completed by early 2025.

Once the funds are raised, they will be utilized to Develop new products, Improve the bank’s payment network, and hire more skilled professionals. In addition, the bank aims to buy a stablecoin-focused payments company in the Middle East or Europe, specifically by the first quarter of 2025.

The Role of Stable coins

On the other hand, stablecoins are digital currencies pegged to traditional money, such as the US dollar. They are gaining popularity because they provide faster, cheaper, and more accessible payment options than traditional banking systems.

Singapore Gulf Bank is also known for its crypto-friendly services. For instance, corporate clients manages traditional financial assets alongside cryptocurrencies on one platform. By the end of 2024, the bank plans to extend these services to individual customers.

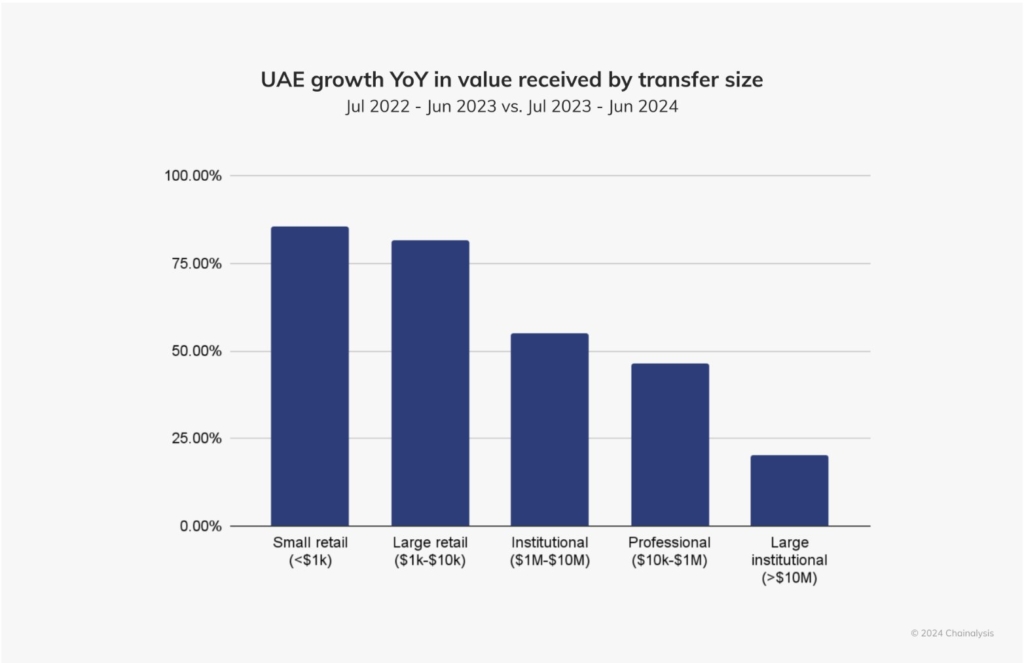

In the recent chain analysis the Middle East is becoming a hub for cryptocurrency and blockchain businesses, with countries like Bahrain, Dubai, and Abu Dhabi providing much-needed regulatory clarity. According to a recent report, an impressive 93% of crypto transactions in the region involve high-value trades worth $10,000 or more. Therefore, Singapore Gulf Bank’s expansion perfectly aligns with this trend. The bank aims to support Bahrain’s efforts to lead cross-border digital transactions by offering secure and compliant financial solution.

The bank’s decision to invest in stablecoins comes with renewed optimism in the crypto sector. With global markets recovering and regulatory clarity improving, the bank sees stablecoins as a critical bridge between traditional finance and the decentralized economy.

As SGB backed by the Whampoa Group and Bahrain’s sovereign wealth fund, Its expansion plans reflect confidence in blockchain-backed payment solutions and the stablecoin market, for broader adoption in the digital economy. By acquiring a stablecoin payments company and expanding its services.