- SGX will launch Bitcoin perpetual futures in H2 2025 for institutional clients.

- The offering is pending approval from the Monetary Authority of Singapore.

Singapore Exchange Ltd. (SGX) plans to launch Bitcoin perpetual futures in the second half of 2025. The offering will cater exclusively to institutional clients and professional investors. Retail traders will not have access, according to a Bloomberg report.

The planned contracts are still awaiting regulatory approval from the Monetary Authority of Singapore. Unlike traditional futures, perpetual contracts have no expiration date. They allow traders to speculate on Bitcoin’s price movements continuously.

This move aligns with the broader trend of traditional exchanges embracing crypto derivatives. Japan’s Osaka Dojima Exchange Inc. is also seeking approval to list Bitcoin futures. Institutional interest in cryptocurrency is increasing, particularly amid pro-crypto policies from the U.S. government.

Expanding Institutional Crypto Access

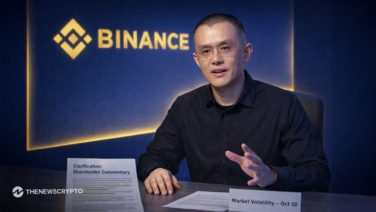

SGX’s spokesperson stated that the exchange expects its offering to “significantly expand institutional market access.” The initiative may also help address credit risks tied to unregulated platforms like Binance and OKX. Offshore exchanges currently dominate the perpetual futures market, but SGX aims to bring regulatory oversight to this space.

Singapore has positioned itself as a key hub for cryptocurrency businesses. Regulatory clarity and institutional-friendly policies have attracted firms seeking a compliant market. Robinhood Crypto is also expanding its presence in Singapore. The company acquired Bitstamp for $200 million in 2024 and aims to launch crypto services in the country by late 2025.

Bitstamp received in-principle approval from Singapore’s regulators last year. The exchange will act as a gateway for Robinhood’s entry into the Singaporean market. With more financial institutions embracing crypto, SGX’s move strengthens its role as a bridge between traditional finance and digital assets.

The exchange’s Bitcoin perpetual futures could offer institutions a secure alternative to unregulated derivatives markets. If approved, the offering will likely attract major trading firms seeking compliance and security in crypto investments.

Highlighted Crypto News Today

Unknown Attack on Pectra Upgrade Further Delays Launch on Mainnet