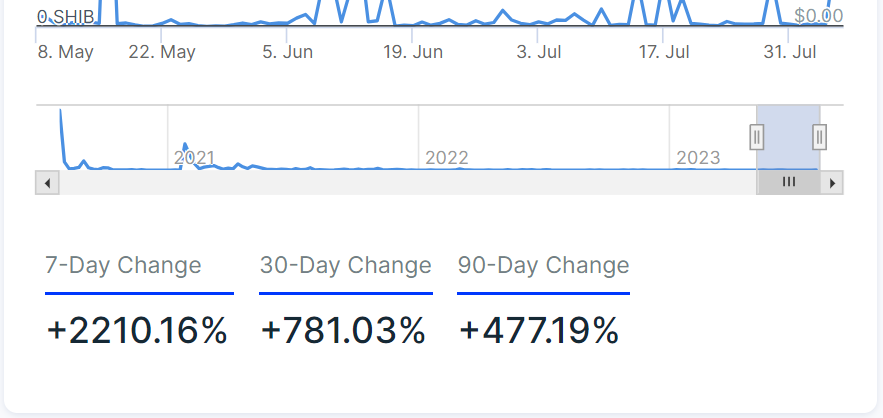

Shiba Inu (SHIB) has experienced a jaw-dropping surge in large holders’ inflow, according to data from IntoTheBlock. Over the course of the last seven days, the large holders’ inflow metric has skyrocketed by a remarkable 2,210%. This significant increase in funds flowing into addresses owned by whales or major holders could have potential implications for the market.

The surge in large holder inflows could be indicative of two possible scenarios. Firstly, it might signal a market bottom, as major addresses or whales tend to make bulk purchases after significant price declines. Secondly, the notable increase could indicate robust buying activity, as many of these addresses purchase SHIB on centralized exchanges and subsequently transfer their holdings to cold storage.

Shiba Inu surge followed by drop in price

The timing of this surge in large holder inflows aligns with SHIB’s recent price drop, attributed to profit-taking by investors. On August 5, SHIB experienced a massive spike, reaching highs of $0.0000105. However, following this surge, investors decided to take profits, leading to a decline in the token’s price. At the time of writing, SHIB was down 4% in the last 24 hours, currently trading at $0.000009.

The movement of SHIB tokens among whales has also drawn attention. Crypto data tracker Whale Alert reported significant token transfers within the last 24 hours. Notably, a colossal 8.7 million SHIB tokens were moved between whales’ wallets. One single transaction accounted for 4,382,252,578,938 SHIB tokens, valued at $40,064,744, while another saw 4,412,252,578,938 SHIB tokens, worth $40,672,144, being transferred between wallets.

As SHIB continues to navigate its price fluctuations and investor sentiment, market participants are closely monitoring the actions of large holders and the potential implications on the cryptocurrency’s overall performance. The cryptocurrency space remains dynamic and ever-changing, making it crucial for investors to stay vigilant and informed.