- SHIB declines amid bearish market, hitting 18-day low.

- SHIB burns nearly 380M tokens in July, decreasing from June.

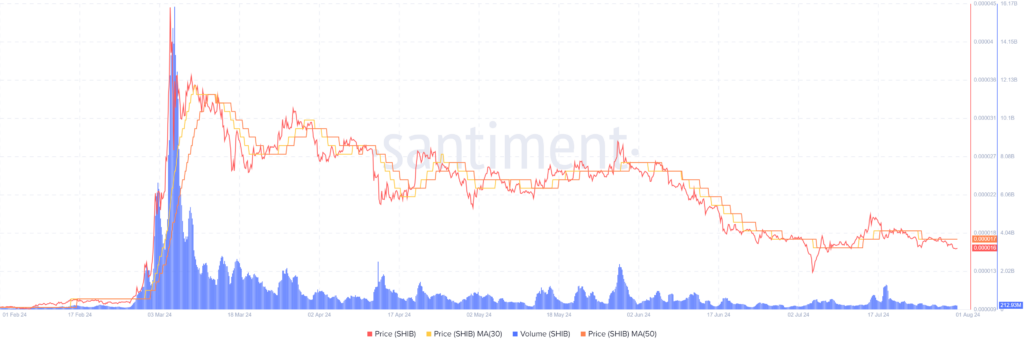

The cryptocurrency market is currently experiencing a bearish phase, with the global crypto market cap dropping by 3.17%. Despite this, trading volume has increased by 21%. Bitcoin has hit a 13-day low of $63,573.63, declining by 3% in the past 24 hours. This downturn has affected altcoins, which have fallen between 4-8%. Shiba Inu (SHIB) has also declined by 2.83%, reaching an 18-day low of $0.00001562.

Meanwhile, the SHIB team has ramped up its token-burning program, sending tokens to a null address. Data shows that nearly 380 million tokens were destroyed last month across 178 transactions. The peak burning day was July 11, with over 70 million SHIB burned, followed by July 22 with approximately 60 million SHIB.

Despite these figures, the USD equivalent of the burned tokens is relatively insignificant. Additionally, July’s burn rate represents a 58.5% decrease compared to June.

Meanwhile, data from IntoTheBlock indicates a notable increase in substantial Shiba Inu transactions over the last week. This spike in activity from large investors is generally seen as a positive signal, indicating the growing confidence among these stakeholders.

Will SHIB Price Go Up?

Shiba Inu’s recent price action reflects a bearish trend, with the 9-day EMA at $0.00001653 and the daily Relative Strength Index (RSI) at 38, indicating potential selling pressure. However, trading volume has increased by 17% in the past 24 hours.

If bulls regain control, SHIB could rise to $0.00001653 and possibly higher. Conversely, if bears dominate, SHIB could initially retrace to $0.00001302 and potentially fall further. Bitcoin could also retrace to $56,465 initially, potentially falling further to $53,450 in a more pronounced decline.

The outlook for the prominent memecoin, SHIB remains uncertain, with market dynamics heavily influenced by broader crypto trends and investor sentiment.

Highlighted News Of The Day

Spot Ethereum ETFs See $77.2M Outflow Amid Market Volatility