SEC Vs Crypto Industry

It is a one more turbulent year for the cryptocurrency industry after the U.S Securities and Exchange Commission (SEC) sued crypto titans such as Binance and Coinbase. The SEC lawsuit related to securities violations, including the unregistered offers and sales of the respective tokens.

These legal lawsuits highlighted the increased regulatory scrutiny surrounding the cryptocurrency industry. Also, regulatory authorities worldwide have been taking steps to ensure compliance within the rapidly evolving digital asset landscape.

Let’s dive into the SEC lawsuit against the major player in the crypto market, which is currently focusing on the centralized cryptocurrency exchanges. In 2022 the SEC charged two key players FTX and its CEO Sam Bankman Fried as well as Terra Labs and its CEO Do Kwon. They failed to prove their loyalty in the industry and led the crypto market in the down fall.

However Ripple Labs which is still trying to come over from the SEC battle from 2020. In addition, the year 2023 led two more big shots exchanges Binance and Coinbase to face legal actions from the SEC.

SEC vs Ripple

The Ripple vs SEC lawsuit has been a significant event in the cryptocurrency industry since it was filed in December 2020. Here are the key points and developments in the case:

Ripple Labs, along with its co-founder Christian Larsen and CEO Brad Garlinghouse, were sued by the SEC for allegedly conducting an unregistered securities offering through the sale of XRP tokens. The SEC demanded that Ripple surrender the $1.3 billion raised from the token sales and requested a ban on the defendants from selling tokens in the crypto market.

Ripple and its executives maintained that XRP is not a security but rather a decentralized digital currency that does not fall under the SEC’s jurisdiction. But the SEC argued that XRP met the criteria of a security asset based on the “Howey test,” emphasizing the role of Ripple in promoting XRP’s profitability.

Both parties employed strategic moves in the case, with the SEC gathering global regulatory information and appointing Gary Gensler, who has knowledge of crypto technology, as the SEC chair. Ripple sought the presence of Bill Hinman, a former SEC chair, to support their argument.

Both sides have prolonged the court proceedings by requesting documents and information from each other. Ripple accused the SEC of showing partiality, while the SEC pointed to the negative sentiments and mockery faced by XRP holders.

Further, XRP’s price has been affected by the SEC vs Ripple battle, experiencing fluctuations based on the perceived outcomes of the court proceedings.

In October 2022, the SEC was ordered to turn over the “Hinman Documents,” which was seen as a victory for Ripple. However, the investigation and litigation are ongoing. As a result of this, Ripple’s CEO has expressed confidence in winning the lawsuit by the first half of 2023.

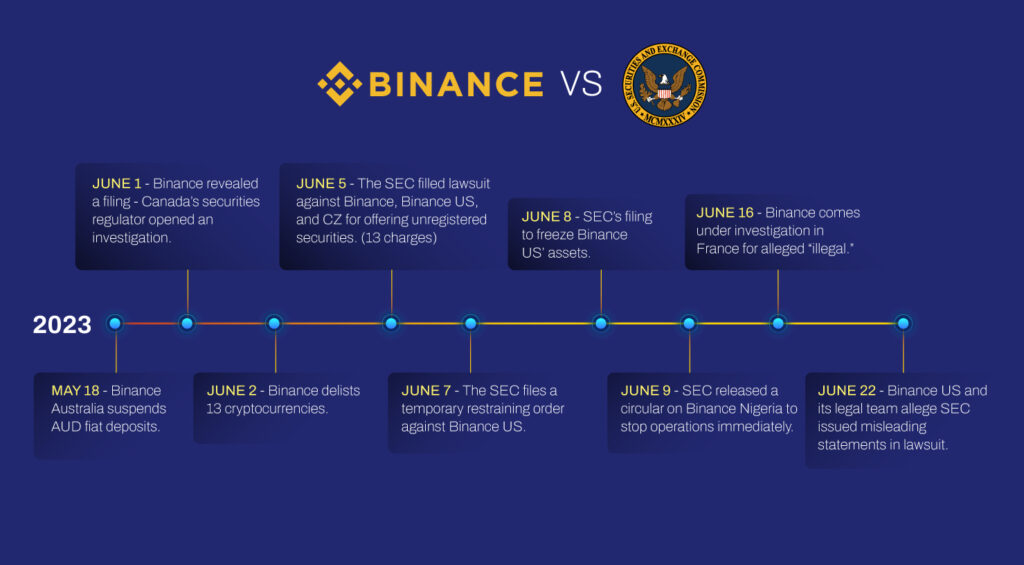

SEC vs Binance

On June 5 2023, the U.S. Securities and Exchange Commission filed 13 charges against Binance and Changpeng Zhao (CZ), alleging actions such as allowing high-value U.S. customers to trade on the platform and exerting control over customer assets.

Binance responded by accusing the SEC of attempting to unilaterally define the crypto market structure and prioritizing headlines over investor protection. In addition, the SEC Nigeria issued a circular ordering Binance Nigeria Limited, a separate local entity, to cease operations immediately, clarifying it is not related to Binance or CZ.

Following that, Binance withdrew its registration with Cyprus’ Unit Crypto Service, which it obtained in October 2022, requiring the provision of various services in the country.

Further, Binance decided to cease operations in the Netherlands due to the failure to acquire a virtual asset service provider license, and its French unit is under investigation for alleged illegal provision of digital asset services and aggravated money laundering.

The U.S. SEC announced emergency relief for Binance customers in the United States, imposing restrictions on the spending of corporate assets by all defendants, including Binance.

Last week, Binance US resolved its USD withdrawal problems by collaborating with banking partners and advised users to convert USD funds to stablecoins due to potential service discontinuation by financial partners.

Moreover, Binance has been ordered by the FSMA to suspend its crypto services in Belgium. iting the immediate halt of digital asset offerings in the country. Binance’s crypto services will now only be available in countries outside the European Economic Area.

However, the largest crypto exchange is facing many scandals from various forms, which is still ongoing. Also, in March, the Commodity Futures Trading Commission (CFTC) charged Binance and CZ. With multiple violations of the Commodity Exchange Act (CEA) and CFTC regulations.

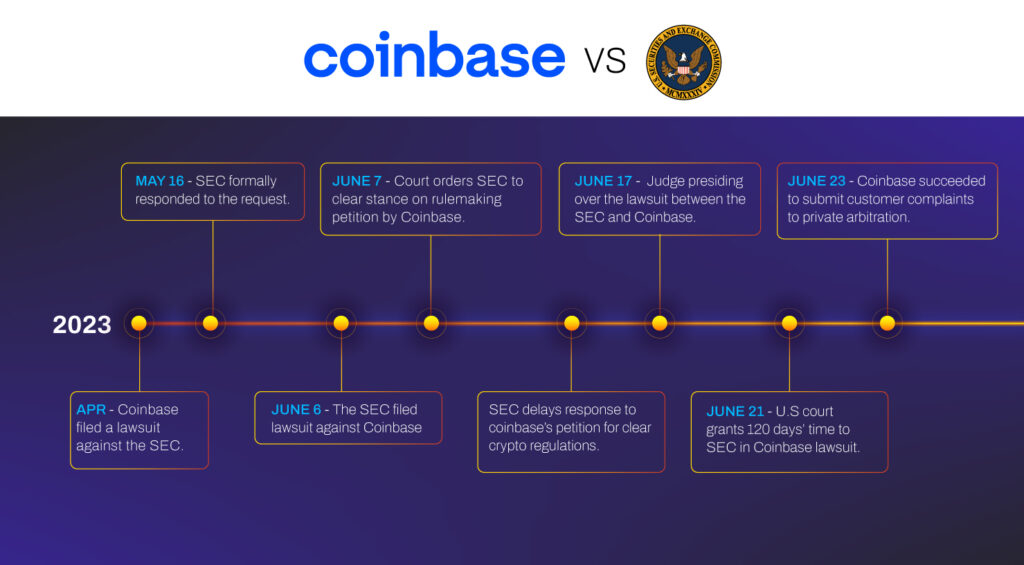

SEC vs Coinbase

In April, Coinbase, one of the largest centralized exchanges, took a significant step by filing a lawsuit against the U.S. SEC. The lawsuit was a response to Coinbase’s frustration with the SEC’s lack of clear guidelines and regulatory clarity for the crypto industry.

On May 16, the SEC formally responded to Coinbase’s lawsuit, indicating its intention to defend its actions and regulatory approach. This response set the stage for a Coinbase vs SEC legal battle.

Subsequently, on June 6, the SEC filed its own lawsuit against Coinbase, accusing the exchange of conducting unregistered securities offerings. The SEC’s lawsuit alleged violations of the securities laws by Coinbase and sought legal remedies for these alleged violations.

Amidst the legal proceedings, on June 7, the court ordered the SEC to provide clarity on a rulemaking petition submitted by Coinbase. This order aimed to compel the SEC to address Coinbase’s request for clear regulations in the crypto industry.

However, the SEC chose to delay its response to Coinbase’s petition for clear crypto regulations, further prolonging the uncertainty surrounding the regulatory framework for cryptocurrencies.

On June 17, a judge presided over the SEC vs Coinbase lawsuit. Overseeing the legal arguments presented by both parties and evaluating the merits of their respective claims.

Later, on June 21, a U.S. court granted the SEC an additional 120 days to respond to Coinbase’s lawsuit. This extension allowed the SEC more time to prepare its case and formulate its legal arguments against Coinbase.

Despite the ongoing Coinbase vs SEC legal battle, the crypto exchange achieved a notable milestone on June 23. That it succeeded in submitting customer complaints to private arbitration. This move aimed to resolve disputes between Coinbase and its customers through an alternative dispute resolution process. Potentially avoiding prolonged court proceedings.

What does this Means for Crypto Market?

The recent lawsuits against Coinbase and Binance, along with previous actions against other crypto companies, are contributing to increased uncertainty and decreased confidence in the entire cryptocurrency sector. This ongoing legal scrutiny poses significant challenges for the crypto world as a whole.

Overall, the centralized crypto exchanges vs. SEC lawsuit also represents trust issues between the communities. The outcome of these legal battles will likely have far-reaching implications for the crypto industry’s regulatory landscape.

What are Securities?

Securities are financial instruments that represent ownership or an interest in a company, entity, or investment vehicle. They can take various forms, including stocks, bonds, options, futures contracts, and investment contracts. Securities are regulated by governmental bodies to protect investors and ensure fair and transparent markets.

Why is the SEC Accusing Cryptos as Securities?

The Securities and Exchange Commission in the United States is the primary regulatory authority responsible for overseeing the securities industry. The SEC’s main mandate is to protect investors, maintain fair and efficient markets, and facilitate capital formation.

The SEC’s accusation of certain cryptocurrencies as securities stems from their interpretation of the existing securities laws and regulations. According to the SEC, if a digital asset meets the criteria of the Howey test (established through court rulings), it can be considered an investment contract and thus fall under the definition of a security.

This means that the offering, sale, and trading of such cryptocurrencies may need to comply with securities laws. Including registration requirements and disclosure obligations. To be classified as a security according to the SEC’s criteria:

- The acquisition of the asset should acquire through monetary investment

- It should be offered on a shared enterprise or platform.

- There should be a reasonable expectation of profit.

- A third party should influence the potential profit through their actions.

Further, by categorizing certain cryptocurrencies as securities, the SEC seeks to subject them to regulatory oversight. Thereby promoting investor protection and market integrity.

Cryptocurrencies are Securities?

It’s important to note that not all cryptocurrencies are classified as securities. Some digital assets, such as Bitcoin and Ethereum, are generally considered as decentralized currencies or commodities rather than securities. The determination of whether a specific cryptocurrency qualifies as a security depends on the specific characteristics and circumstances. That surrounding the offering and its compliance with securities laws.

Difference Between Commodities and Securities

- Commodity: Tangible raw material or agricultural product traded based on physical attributes. In contrast, buying commodities involves obtaining the goods themselves, even before they exist

- Security: Financial instrument representing ownership, debt, or investment subject to regulatory oversight. When purchasing stock, you acquire ownership and control in a corporation.

Final Thoughts:

These lawsuits highlight the need for clearer regulations and compliance in the rapidly evolving digital asset landscape. The outcomes of these legal battles will have significant implications for the regulatory landscape of the crypto industry. Also, it may impact investor confidence and market stability. It is crucial for the crypto sector to navigate these challenges and work towards establishing a more secure and regulated environment for all Hodlers involved.

Recommended for you

Ripple Revels in Legal Struggles: The SEC Lawsuit Advantage

Crypto Exchange Binance Withdraws License Registration in Austria

Coinbase Scores a Legal Victory as the Supreme Court Rules in Its Favor