Grid trading is a strategy that includes placing a series of buy and sell orders at a predefined range around a fixed price. This works best in a ranging sideways market with no clear direction. As it is unrelated to market behavior, grid trading with a trading bot is easier and more efficient than trying to master the strategy with manual trades. It is popular in the crypto trading community because anyone can easily set up the strategy in automation and let it run 24/7. Traders can make a profit without keeping an eye on price movements.

The flexibility to pick your strategy allows you to control the risk/reward ratio more actively than other trading bots. The frequency and period of the strategy are determined by the price range and the number of grids you choose. The bot takes advantage of any market movement and ensures that orders get placed as soon as there’s a fluctuation in price. You can generate consistent profits with a low-risk option like stablecoin trading or take higher chances with a volatile low-cap coin.

Bitsgap brings you two of the most popular grid bot strategies in the form of classic and Sbot. If you are new to this or planning to utilize these options in the future, you might be wondering which one to go for. Here’s a breakdown!

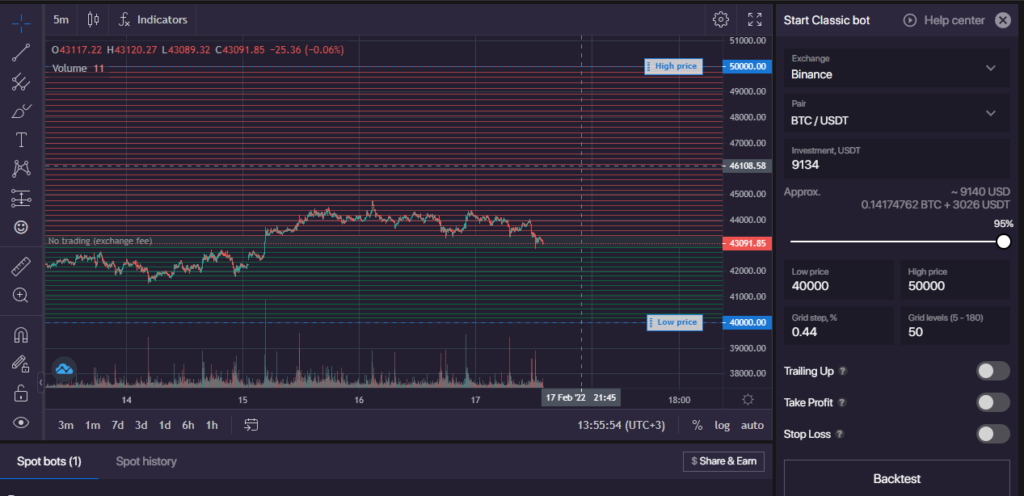

What is a Classic bot and when to use it?

The classic strategy includes buying and selling a fixed amount of the base currency per order. The automated action is based upon market fractals, and it never goes beyond the base limit you have set up.

Classic bot buys and sells equal amount of base currency despite the price

Suppose you use ETH as your base and set 10 ETH as the limit. The bot will sell 10 ETH to book profits at different levels when the price rises. Similarly, it will buy 10 ETH at predefined levels when the price drops. This gives you a sense of control even when it is being executed through an algorithm.

The best time to use this strategy is when you predict a strong uptrend in the market. The classic bot has a proven record in a rising market compared to other strategies. The investment distribution logic of this model provides better exposure as the price elevates.

How different is the SBot strategy?

SBot is an evolved version of the Classic bot with a slightly different investment distribution logic. Here, you can set a limit in the quote currency (fiat) for buying and selling virtual assets. The SBot equally allocates the investment across the grid with buy and sell orders so that the investment amount is always the same as you have set.

Sbot buys and sells a certain amount of base currency with the same amount of quote currency.

For example, if you are looking to buy and sell ETH with a quote currency limit of 100 USD, the bot will make a purchase of that amount each time the value of ETH goes down. Similarly, it will sell $100 worth of ETH each time the value goes up.

The strategy works best when the market is going sideways within a horizontal range. It also uses the Dollar-cost-averaging method to help you accumulate the cryptocurrency and generate profits in base currency.

Both strategies have their merits and demerits. You should look into switching out your options according to market fractals. They create a more realistic picture of market risks and allow you to predict sharp declines and explosive growth. The bots can be used interchangeably to maximize profits in fluctuating conditions!

Disclaimer: The opinion expressed in this chart solely author’s. It does not interpreted as investment advice. TheNewsCrypto team encourages all to do their own research before investing.