- FTX and FTX US have collected funds of $400 million as of Jan 2022.

- Voyager rejected FTX’s proposal as it seemed biased toward the borrower.

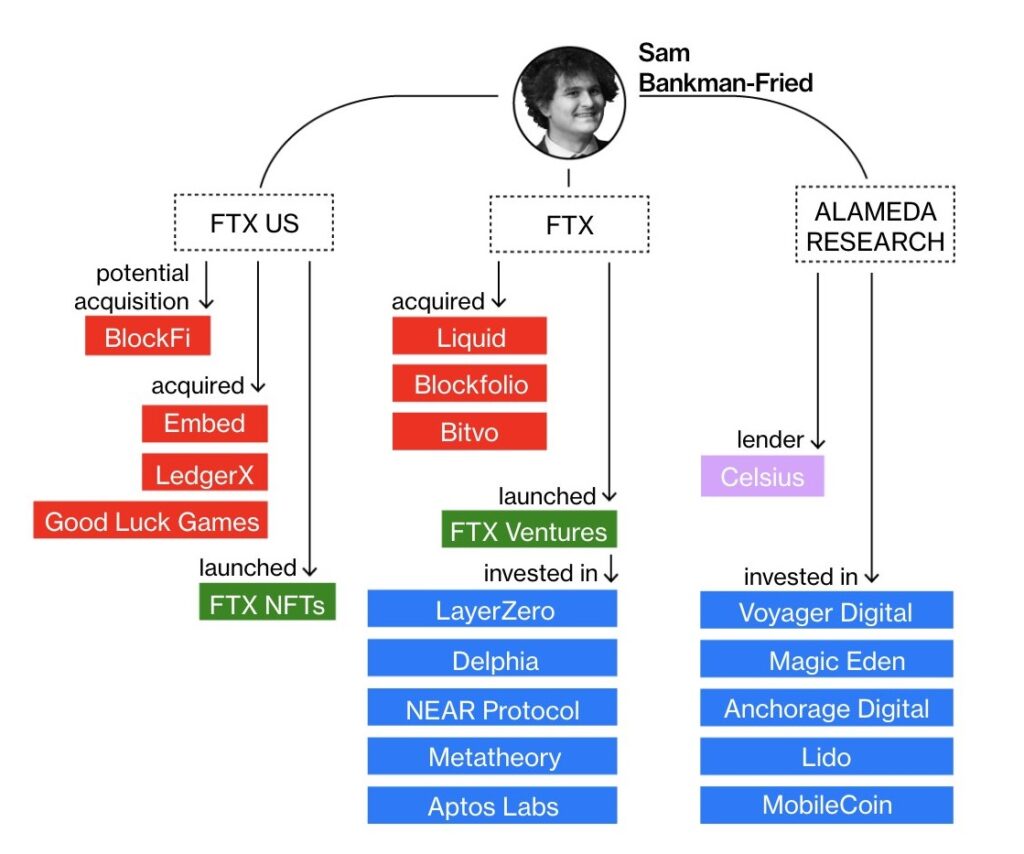

Sam Bankman-Fried (SBF), the CEO of FTX, has been the rescuer for various exchanges and firms in the crypto catastrophe. He is either a lender, or borrower, and has made a presence in every firm’s struggle during this crypto winter.

The recent add-ons to the FTX and Alameda Research are LedgerX, Bitvo, and BlockFi. The company and the billionaire are also raising funds to help other organizations. In Jan, FTX and FTX US combinedly collected $ 800 million at a $40 billion valuation.

SBF has rejected many firms’ requisitions for lending and has faced a few rejections for the offer he made too. Many in the market have the opinion that the purchases he makes are all for the return on those investments. Rather than safeguarding the crypto market in times of struggle.

Voyager’s Rejection to Proposal

On July 22, FTX along with the partnership of Alameda Research made a proposal to Voyager Digital. The proposal was to take over the firm along with the funding struggles apart from the Three Arrow Capital hedge fund. The focal point was the option for Voyager’s customers to liquidate their investment.

But on July 24, Voyager rejected the proposal stating it was advantageous to only FTX and the position of the Voyager investors would remain unchanged. A few reasons which were mentioned by Voyager’s lawyer are the burden of migration and wind-down expenses.

Voyager’s document also states:

“No customer will be made whole under the Proposal, nor will any cryptocurrency be returned to customers under the Proposal.”

Also, Voyager claims the proposal from FTX has disturbed the bankruptcy process. The firm is intended to work steadily in the restructuring process and value-maximization for its customers.

Recommended For You