- Ripple (XRP) investors are holding firm despite price declines, supported by increasing Mean Coin Age (MCA) that indicates less selling.

- XRP has stabilized at $0.48, avoiding a further drop to $0.42, and is now close to the crucial $0.60 level.

- If XRP maintains the $0.47 support, it could see a rise towards $0.60, but a break below this level may result in further losses.

Ripple (XRP) holders have demonstrated remarkable resilience in the face of recent price declines. As the asset exhibits muted performance, through a period of market turbulence, investors have exhibited a steadfast commitment to their holdings, potentially setting the stage for a bullish resurgence.

While a bearish pattern initially led to a downturn in XRP’s price, investors have responded with unwavering patience and a reluctance to sell their assets.

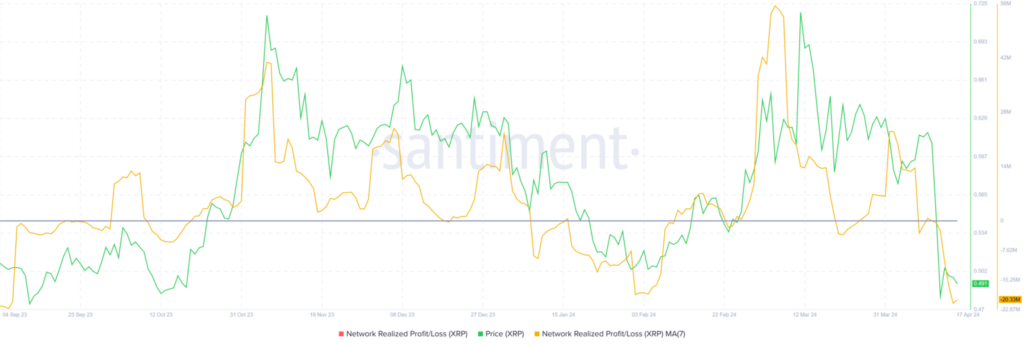

The network realized profit/loss indicator, which tracks the overall profitability of investor holdings, reveals that a significant portion of XRP holders are currently experiencing losses following the recent price decline.

Investors have historically followed such instances with periods of accumulation or a concerted effort to hold onto their assets (HODL). This behavior stems from the recognition that selling during times of market volatility would only exacerbate their losses, prompting investors to refrain from active participation in the network until conditions improve.

What’s next for Ripple (XRP)?

The Mean Coin Age (MCA) indicator further substantiates the resilience of Ripple investors by measuring the average age of all coins within a cryptocurrency network. Typically, investors interpret an increase in the MCA as a sign of holding onto their assets, while a decline suggests heightened activity as coins move between addresses, potentially signaling selling pressure.

In the case of XRP, the MCA indicator has shown a notable incline, reinforcing the narrative of patient holders and potentially building bullish momentum. This resilience among investors could drive a resurgence of buying activity, potentially propelling the price back upwards.

Despite the initial bearish pattern that triggered a correction, XRP’s price has managed to halt its decline at $0.47, defying the anticipated 25% drawdown that would have sent the token to $0.42. Currently trading at $0.48, the Ripple token now stands a mere 13% away from reclaiming the crucial $0.60 support level.

Considering the factors at play, including investor resilience and the potential for accumulation, the likely outcome for XRP appears bullish. Analysts suggest a 13% price increase could help the cryptocurrency reclaim the $0.60 level, potentially paving the way for further gains.

However, if we breach the critical support of $0.47, we could see a 13% decline, which would invalidate the bullish thesis and validate the previously anticipated bearish pattern.