- Ripple launches crypto custody services for banks and fintech firms.

- XRP whales move 73M tokens amid regulatory uncertainty and market speculation.

Ripple has launched new crypto custody services aimed at helping banks and fintech firms store digital assets. Announced on Thursday, the services are part of the company’s Ripple Custody division, offering features such as integration with Ripple’s XRP Ledger blockchain, enhanced anti-money laundering (AML) monitoring, and an improved user interface.

Notably, Ripple is known for its XRP cryptocurrency and RippleNet, a blockchain-based payment settlement platform. This move into custody services allows Ripple to diversify beyond payments and enter a nascent yet rapidly growing market. The crypto custody sector is forecasted to reach $16 trillion by 2030, according to the Boston Consulting Group. Ripple’s major clients, including HSBC and Societe Generale, have already adopted the new services.

Meanwhile, Ripple faces continued challenges over XRP’s regulatory status. Last week, the U.S. Securities and Exchange Commission (SEC) appealed a 2023 court ruling that stated XRP is not a security when sold to retail investors. Amid these legal tensions, XRP whales moved over 73 million tokens in the past 24 hours, sparking speculation of a cross-appeal by Ripple.

Ripple Effect On XRP

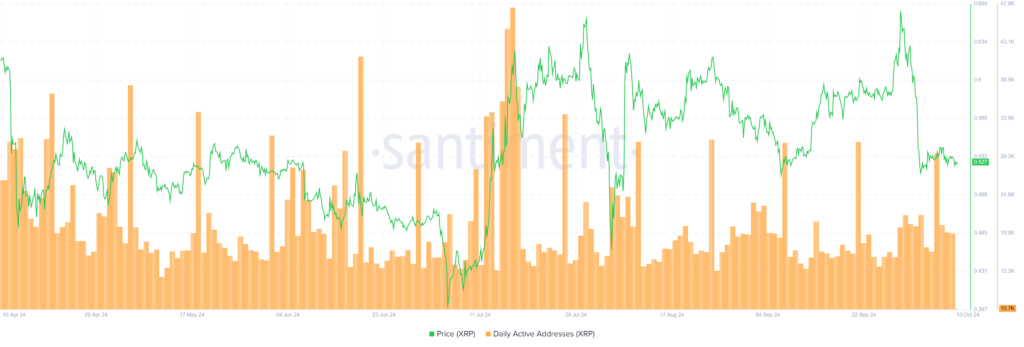

Whale movements, paired with Ripple’s legal battle, have heightened market volatility. XRP’s price recently dipped to $0.5266, with its value fluctuating in response to legal developments. Additionally, speculation has grown around the launch of an XRP exchange-traded fund (ETF), with Canary Capital filing for a U.S. spot XRP ETF on October 8.

Market observers, such as Nate Geraci of ETF Store, believe an XRP ETF approval is likely but dependent on regulatory clarity, which may only emerge after the U.S. elections. Ripple continues to maintain that XRP should not be classified as a security, as it prepares for a potential cross-appeal against the SEC.

XRP technical indicators suggest that it is in bearish momentum. Its 9-day EMA is at $0.5389. The daily RSI stands at 46, showing that it is nearing an oversold condition.

If demand holds, it could break resistance at $0.5463 and push toward $0.5788. However, slowing accumulation could lead to a drop in price to the support level of $0.5118 and $0.4885.