- Ripple CLO criticises Crenshaw’s anti-crypto stance and legal defiance.

- Crypto leaders urge Senate to block Crenshaw’s renomination over policies.

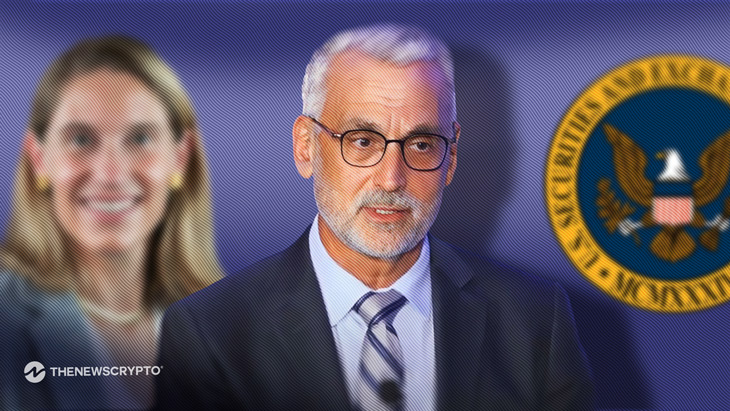

Ripple’s Chief Legal Officer (CLO), Stuart Alderoty, has ignited a heated debate by calling U.S. Securities and Exchange Commission (SEC) Commissioner Caroline Crenshaw “even more rogue than Gensler.” His comments come as the Senate Banking Committee is poised to vote on Crenshaw’s renomination, a decision that has drawn significant attention from the cryptocurrency industry.

In a recent post on X (formerly Twitter), Alderoty accused Crenshaw of defying legal judgments. He highlighted her dissent against a court ruling that deemed the SEC’s denial of Bitcoin spot Exchange-Traded Funds (ETFs) “arbitrary and capricious.” Unlike outgoing SEC Chair Gary Gensler, who accepted the decision, Crenshaw reportedly continued to oppose it, arguing the court was wrong. “Unelected bureaucrats are not above the law,” Alderoty remarked.

Meanwhile, Crenshaw has been a controversial figure within the crypto community, with critics labelling her as one of the most anti-crypto regulators. Her policies, including opposing Bitcoin ETFs, have been described as a hindrance to innovation. Ripple’s CLO is among several industry leaders urging the Senate to reject her reappointment. He argued that her approach could stifle progress in the digital asset space.

Crenshaw’s Policies Spark Crypto Controversy

The opposition to Crenshaw comes as President-elect Donald Trump has nominated pro-crypto advocate Paul Atkins to succeed Gensler as SEC Chair. Crypto lobbying groups like the Blockchain Association have also voiced their concerns, urging lawmakers to block Crenshaw’s renomination. They argue her views are misaligned with congressional objectives and industry innovation.

Meanwhile, Coinbase CEO Brian Armstrong has echoed these sentiments. He criticized Crenshaw’s tenure as a “failure” and warned that her policies are out of touch with the future of finance.

As the Senate Banking Committee prepares to vote, the stakes are high. A confirmation could reinforce perceived regulatory hostility, while rejection might signal a turning point toward a more crypto-friendly regulatory environment.

Highlighted News Of The Day