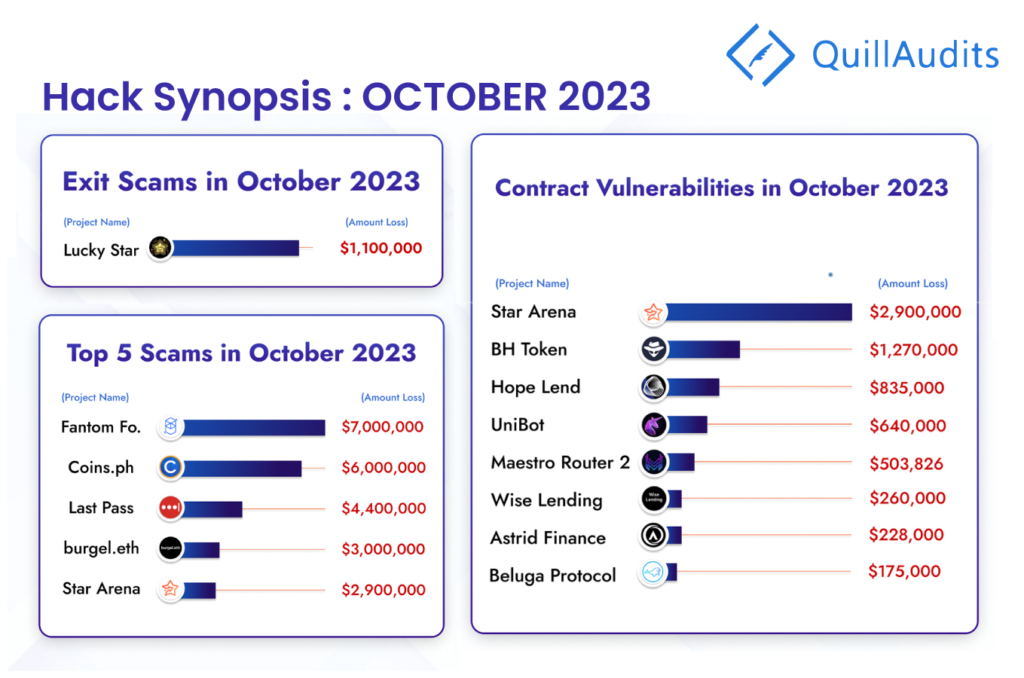

- A recap of the top 5 scams and significant losses that distressed the crypto community in October.

- Smart contract vulnerabilities remain the primary cause of most of these incidents.

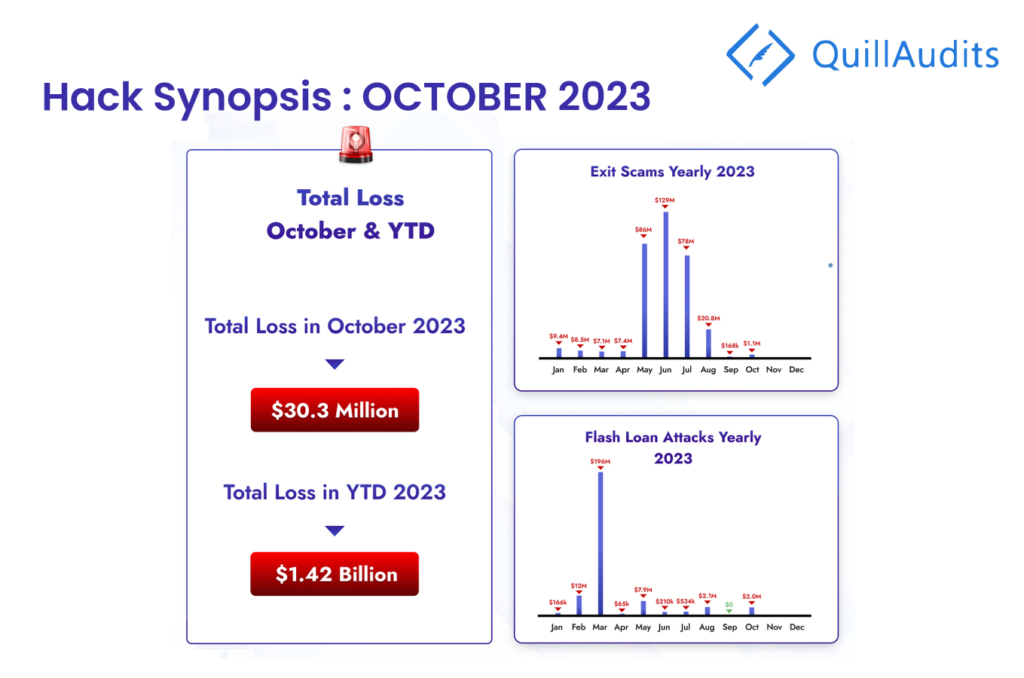

QuillMonitor, a web3 dashboard powered by QuillAudits, recently unveiled its findings, shedding light on the magnitude of the losses incurred due to various hacks and vulnerabilities during the October month.

With a total of $30,311,862 in losses, it’s clear that October 2023 witnessed its fair share of web3 attacks and scams that left the crypto community and investors shocked.

Of all the occurrences, smart contract vulnerabilities took center stage, accounting for 8 out of the 14 incidents that occurred in October. These vulnerabilities exposed the vulnerability of project code, leading to substantial financial losses for both users and organizations.

However, it’s not just smart contract flaws that the crypto community had to contend with. Scams also played a significant role in contributing to the losses. Here, we delve into the top 5 scams that left a mark on October’s crypto landscape:

- Fantom Foundation – $7 million: This unfortunate incident was attributed to other vulnerabilities unrelated to smart contracts, demonstrating that hackers and fraudsters are smarter in exploiting the weaknesses of the growing crypto space.

- Coins.ph – $6 million: The Philippines-based cryptocurrency wallet and exchange fell victim to vulnerabilities in web3, resulting in significant financial damage.

- LastPass – $4.4 million: The renowned password management service experienced a loss of $4.4M, which serves as a stark reminder of the risks associated with digital asset management.

- Burgel.eth – $3 million: A private key compromise led to a $3M loss for Burgel.eth, emphasizing the importance of safeguarding private keys, which are essentially the keys to one’s crypto treasury.

- Star Arena – $2.9 million: A vulnerability in the smart contract resulted in a loss of $2.9M for Star Arena, highlighting the need for thorough security audits and continuous monitoring in the DeFi space.

The prominence of smart contract vulnerabilities that accounted for a substantial financial toll of approximately $6,811,862 underscores the critical need for security audits. Such vulnerabilities, as revealed in these incidents, are not only a threat to crypto investments but also jeopardize the stability of entire projects and platforms.

When we consider the year-to-date losses, the amount accumulates to approximately $1.45 billion, underscoring the gravity of the situation. While these losses and scams are undoubtedly concerning, it’s important to note that the crypto space is no stranger to adversity.

The nature of decentralized finance (DeFi) makes it both innovative and vulnerable, as it relies on trustless systems. Nevertheless, the crypto community is resilient and adaptive, constantly working to improve security and mitigate risks.

QuillMonitor’s analysis of the October 2023 hacks and scams offers valuable insights for investors and the entire crypto community. It serves as a reminder of the importance of due diligence, risk management, and security measures when navigating the ever-exciting yet unpredictable space of Web3.

As the crypto space continues to evolve, a proactive and collaborative approach to safeguarding assets and projects is paramount to ensuring a more secure and resilient Web3 environment. These incidents also highlight the need for continued development in the space, with a focus on improving smart contract security, private key management, and vulnerability assessments.

In conclusion, October 2023 was a month that witnessed a range of hacks and notable scams that underscore the importance of best security practices and rigorous smart contract audits of the web3 protocols.