- Some banks in India warn customers with RBI notice.

- RBI clears up the commotion with the further announcement.

- RBI states that they didn’t ask banks to stop the services of exchanges.

Leading banks in India have restricted virtual cryptocurrency services with the statement of RBI given on April 06, 2018.

The Crypto community is cleared up with the commotion caused by some leading Indian banks. The Reserve Bank of India (RBI) clarified the issue on Monday, regarding the crypto services.

RBI states that banks cannot use the circular about the crypto banking ban which was issued in 2018. The central bank has not asked the bankers to stop the crypto-related services.

Moreover, RBI clears up the commotion with a circular on Monday, that bank entities are not supposed to use the circular issued in April as they are not valid after the judgment of Hon’ble Supreme Court on March 4, 2020.

RBI added:

“As a result of the Hon’ble Supreme Court’s order, the circular is no longer valid as of the date of the Supreme Court judgment, and thus cannot be referenced or quoted from,”

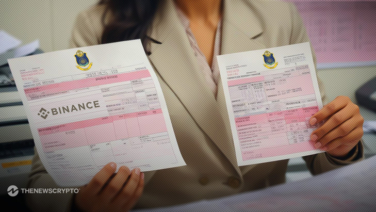

Furthermore, leading Indian lenders HDFC and State Bank of India (SBI), have sent mail to specific customers warning against the virtual currency services. Quoting the RBI’s 2018 circular, they have restricted service regarding digital assets and also mentioned the suspension of cards.

No More Issues on Crypto Trading Service

Although, the Supreme court has already given the judgment regarding the crypto banking ban in March 2020. Nevertheless, some banks have continued to restrict the crypto dealings which caused commotion to local exchanges.

RBI has clearly given the statement that the central bank has not asked the bankers to stop crypto trading services. Besides, they have asked the bankers to ensure the required compliance.

The circular states, “Banks, and other entities mentioned above, may, however, continue to carry out customer due to diligence processes in accordance with regulations governing standards for Know Your Customer (KYC), Anti-Money Laundering (AML), Combating Financing of Terrorism (CFT), in addition to ensuring compliance with relevant provisions under Foreign Exchange Management Act (FEMA) for overseas remittances,”.

Recommended for you