- OFFICIAL TRUMP is hovering around the $7 mark.

- TRUMP’s trading volume has dropped by over 61%.

The bear grip across the crypto assets has resulted in an unclear price movement, riding the collar coaster. With the fear sentiment lingering in the cryptocurrency market, the assets, like Bitcoin (BTC) and Ethereum (ETH), have lost momentum, trading in the red. Meanwhile, OFFICIAL TRUMP (TRUMP) has posted a loss of over 6.92% in value.

The asset opened the day trading at a high of $8.48, and with the bearish pressure in the TRUMP market, the price has been sent to a low of $7.65. If the downside correction continues, the asset’s price may see additional losses, visiting its former support zones. At the time of writing, OFFICIAL TRUMP is trading in the $7.79 range.

Besides, the market cap is staying at $1.55 billion, and the daily trading volume of TRUMP has dropped by over 61.78%, reaching the $698.56 million mark. Additionally, the market has witnessed a liquidation of $5.35 million worth of OFFICIAL TRUMP during the last 24 hours, according to Coinglass data reporting.

Is a Rebound in Sight for the OFFICIAL TRUMP or More Pain Ahead?

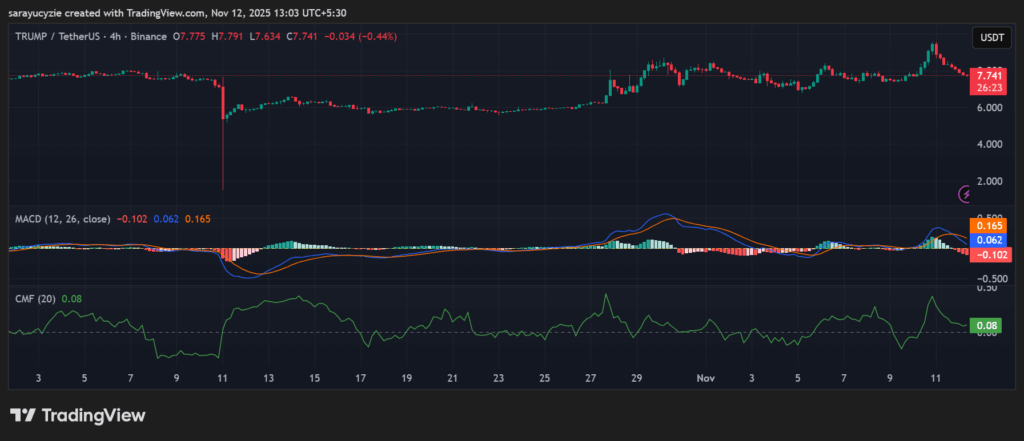

The 4-hour trading pattern of the OFFICIAL TRUMP gives a negative outlook, with the price falling to the support range of $7.71. With the weak momentum, further losses might be initiated, along with the emergence of a death cross. Eventually, the price could retrace toward the $7.63 range.

Assuming the asset enters the green zone, that is a positive sign, and the bulls may push the OFFICIAL TRUMP price climb toward the $7.87 level. Upon the upside pressure gaining more traction, it might trigger the golden cross to unfold, and drive the asset’s price to $7.95 or even higher.

OFFICIAL TRUMP’s Moving Average Convergence Divergence (MACD) line has crossed below the signal line. This crossover indicates bearish momentum, and the asset’s short-term price movement is weak. This is a sign of potential downward continuation until a crossover occurs again.

Moreover, the Chaikin Money Flow indicator is worth noting, found at 0.08, suggesting mild buying pressure in the TRUMP market. As the value is above zero, the money is flowing into the asset, but the momentum is not very strong. A higher CMF value would confirm stronger accumulation.

The daily Relative Strength Index (RSI) resting at 44.23 hints at TRUMP’s neutral to slightly bearish zone. However, it is far from the oversold level, with enough room for either a rebound or further downside depending on momentum. OFFICIAL TRUMP’s Bull Bear Power (BBP) reading of -0.790 points out that the bears have the upper hand in the market. It reflects weak buying momentum and a possible continuation of the downtrend unless bulls step in.

Top Updated Crypto News

Conflux (CFX) Volume Skyrockets 600%: Will the Market Fuel a Fresh Uptrend or See It Fade Away?