- Mt. Gox moved 33,964 BTC worth $2.25 billion to an unknown wallet as part of creditor repayments.

- Over 17,000 creditors have received repayments in BTC and Bitcoin Cash via exchanges like Kraken.

Mt. Gox has taken significant steps to resolve the aftermath of its infamous 2014 hack. In the past 6 hours, the defunct crypto exchange has moved a substantial amount of Bitcoin, signaling the final phases of creditor repayments.

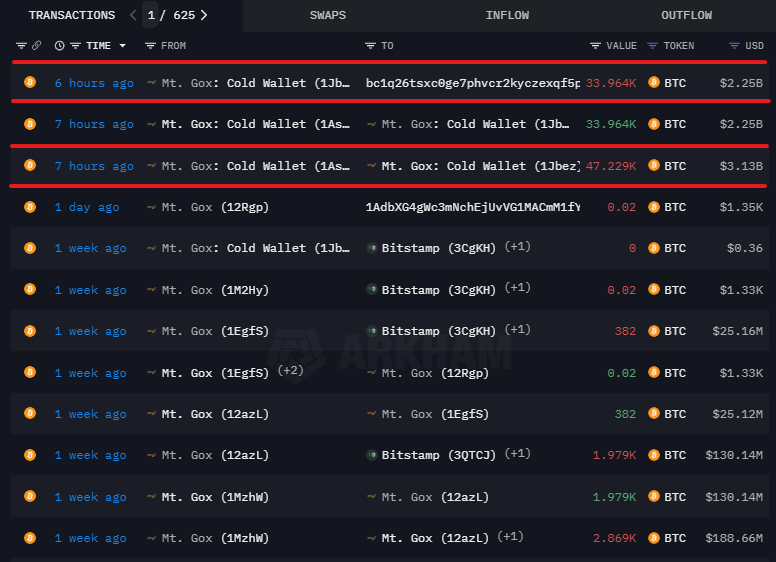

According to the blockchain analytics firm Arkham Intelligence, the exchange transferred 33,964 BTC, worth $2.25 billion, to an unknown wallet as part of the preparations for repayment. This follows an earlier move where 47,229 BTC worth $3.13 billion was shifted to three separate wallets.

Since July 5, the overall transfer activities on Mt. Gox amount to a total of 61,560 BTC, valued at $4 billion. These BTC have been directed towards exchanges such as Kraken, Bitstamp, and SBIVC for creditor repayment. Several exchanges, including Kraken, have already begun the process of returning funds to creditors. Some reports indicate that users with issues related to identity verification have had their payouts denied.

Bitcoin Price Trends Amid Mt. Gox Repayments

As Mt. Gox continues the process of creditor repayments, the price of Bitcoin has displayed significant volatility. It has faced multiple rejections at the $70,000 zone over the month. Even the price of BTC dropped to $53,000 but managed to rebound and is currently stalling above $66,000.

At the time of writing, BTC traded at $65,655 with a market cap of $1.3 trillion. Additionally, the daily trading volume of Bitcoin has dropped over 30% in the last 24 hours to $28 billion.

Mt. Gox’s primary wallet still holds around 80,130 BTC, valued at $5.3 billion. It is unclear if the estate will move these assets to exchange for liquidation.

The Kraken trustee overseeing Mt. Gox has reported the completion of repayments in Bitcoin and Bitcoin Cash to over 17,000 creditors via designated cryptocurrency exchanges. Kraken is one of the five exchanges assigned to facilitate these repayments and continues its efforts to assist the 127,000 affected creditors.