- MARA’s Bitcoin holdings totaled 34,794 BTC with the recent purchase of 703 Bitcoins.

- The firm announced the purchase with its 0% convertible note offerings due 2030.

- Microstrategy purchased 55,500 BTC with its $3B convertible note offerings due 2029.

Bitcoin mining company, MARA Holdings announced an additional acquisition of 703 BTC, totaling 6,474 BTC holdings at an average price of $95,395 per 1 BTC. The company acquired these Bitcoins with its latest 0% $1B convertible notes offering, following in the footsteps of Microstrategy.

With our 0% $1 billion convertible notes offering, we are excited to share an update:

— MARA (@MARAHoldings) November 27, 2024

– Acquired an additional 703 BTC, bringing the total to 6,474 BTC, at an average price of $95,395 per BTC

– YTD BTC Yield Per Share 36.7%

– Total owned BTC: ~34,794 BTC, currently valued at… pic.twitter.com/bzbunlyBRN

As per the announcement posted on X, MARA Holdings company added another 703 Bitcoins to its existing BTC holdings. Combined with an initial purchase of 5,771 BTC, MARA obtained a total of 6,474 BTC in the recent bull trend. With this acquisition, MARA’s BTC holdings amounted to a total 34,794 BTC, valued at $3.3 billion, if we consider BTC’s price to be $95,000.

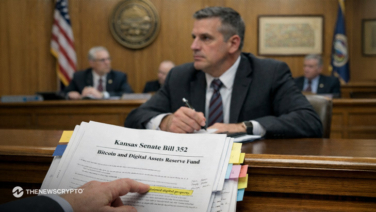

The Trend of 0% Convertible Note Offerings by MSTR and MARA

MARA holdings purchased additional Bitcoins with its 0% convertible senior note offerings worth $1 billion. The firm also purchased a portion of its 2026 notes for $200 million and overall $160 million is available for future Bitcoin dip purchases.

Offering 0% convertible notes is a new fundraising plan started with Microstrategy. While Microstrategy is only a mobile software company that acquires Bitcoins, MARA Holdings is directly linked with BTC, being the largest Bitcoin mining company that mines around 23 BTC per day. Thus, the current fundraising with the zero-coupan notes and BTC purchases could benefit MARA stock more than MSTR.

MicroStrategy has acquired 55,500 BTC for ~$5.4 billion at ~$97,862 per #bitcoin and has achieved BTC Yield of 35.2% QTD and 59.3% YTD. As of 11/24/2024, we hodl 386,700 $BTC acquired for ~$21.9 billion at ~$56,761 per bitcoin. $MSTR https://t.co/79ExzXk4UM

— Michael Saylor⚡️ (@saylor) November 25, 2024

Microstrategy recently purchased 55,500 BTC at an average price of $97,862 per BTC. With this purchase, the firm holds a total of 386,700 Bitcoins as of November, 2024.

Despite the major corporate companies buying Bitcoins with debt financing, analysts say it is risky and unsustainable. In case the bull market ends and Bitcoin goes down, these companies face a huge risk.

Nonetheless, Microstrategy offered convertible notes due 2029 and MARA’s note offerings due 2030. That gives ample time for these companies to cover any short-term risks in case Bitcoin’s price declines.