- Circle’s USDC stablecoin is used to collateralize the vast majority of MakerDAO’s DAI.

- The DeFi protocol has a total locked value of approximately $11 billion.

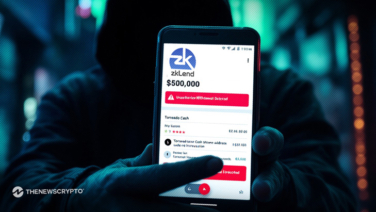

Many prominent leaders in the cryptocurrency sector are reevaluating their dependence on U.S.-based centralized services and products in the wake of the Treasury Department’s shocking move to ban Ethereum coin mixing utility Tornado Cash on Monday.

MakerDAO, a blue chip DeFi protocol, joins this ever-expanding list. Earlier today, MakerDAO founder Rune Christensen made an announcement on the organization’s official Discord channel that it would be considering depegging its native, decentralized stablecoin, DAI, from USDC, a dollar-pegged stablecoin produced by payments business Circle.

Adherence to U.S Sanctions

In light of Circle’s decision earlier this week to blacklist 38 wallets sanctioned in relation to the Tornado Cash ban, the company has decided to reevaluate its stance. Circle froze any USDC in these wallets, which privacy campaigners criticized as corporate complicity with overreaching and illegitimate government censorship.

Although the penalties’ wording did not strictly require Circle to freeze the accounts in question. The American corporation took the precaution out of an excess of caution so as to not draw the ire of the United States government.

Presently, Circle’s USDC stablecoin is used to collateralize the vast majority of MakerDAO’s native stablecoin, DAI. The organization’s reliance on an asset obviously within the reach of American sanctions has come under investigation this week, since the DeFi protocol has a total locked value of approximately $11 billion.

It’s interesting that Rune suggested changing those USDC to ETH. MakerDAO’s DAI stablecoin now has more than 50% of its value collateralized by USDC. That’s why Rune voiced some alarm about the system’s reliance on a single stablecoin and a centralized asset.

Recommended For You:

U.S Supreme Court Rejects Coinbase’s Appeal Over Arbitration