- Littio provides clients with yield-bearing savings pots via OpenTrade, with returns guaranteed by US Treasury Bills.

- Users of Littio’s mobile banking app are overcoming a common obstacle in the LatAm banking industry.

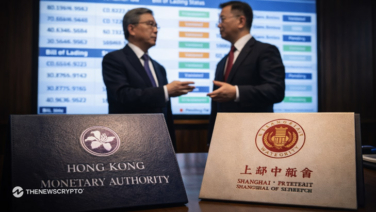

Littio, a Colombian Neobank focusing on tackling the currency depreciation issue for Latin Americans via different dollar-based product offerings, has begun leveraging OpenTrade’s real-world asset (RWA)-backed yield vaults, or “Yield Pots,” via the Avalanche blockchain network. Littio provides clients with yield-bearing savings pots via OpenTrade, with returns guaranteed by US Treasury Bills. Littio can run its product offering at scale on a tested infrastructure thanks to OpenTrade’s RWA yield vaults, which also take into account the ongoing expansion of Avalanche’s on-chain finance ecosystem.

OpenTrade offers companies access to a range of on-chain products and services, such as supply chain finance, structured credit, and lending products for US Treasury Bills, via their B2B2C business model. Tokenization has made it possible to access a large range of financial products and utilities within the last several years. This is especially true in places like Latin America, where investors seek for steady return assets due to double-digit interest rates, excessive inflation, and currency depreciation. With $562 billion in value between July 2021 and June 2022, Latin America accounted for 9.1% of the global cryptocurrency market in 2022. The region’s growing interest in digital assets is seen from the 40% increase in adoption.

Tens of thousands of users of Littio’s mobile banking app are overcoming a common obstacle in the LatAm banking industry: the inability to access dollar-based savings accounts. Approximately 70% of Latin Americans lack access to banking as of 2021, in part because to stringent anti-money laundering regulations, exorbitant interest rates, unreasonably high minimum account balances, few resources, and public distrust of banks. Littio wants to provide the LatAm region unmatched access to a comprehensive range of financial services that enable saving, spending, moving, and now saving secure and affordable via OpenTrade’s Yield Pots. Users may store, move, and spend money in-app or with a Littio debit card by using Littio’s easy, quick, and inexpensive peso to dollar (USDC) conversion. In the previous four months, Yield Pots has unlocked nearly $250K in user returns and completed over $80M in transactions.

Jeff Handler, CCO of OpenTrade

“Littio is a case study in how FinTech’s in LatAm can unlock unprecedented access to U.S. Dollar and interest bearing dollar accounts in a way that is simple to use, and highly secure by leveraging the unique capabilities of USDC/EURC, and OpenTrade’s high-quality asset-backed yield products on the Avalanche Blockchain. Littio has done a fantastic job packaging everything into a truly top notch end user facing experience, and we look forward to continue to help support their growth moving forward.”

Littio is moving its assets from OpenTrade’s Ethereum vaults to Avalanche vaults in order to expand with increasing demand. For institutional deployments and tokenized assets, Avalanche’s low transaction costs, stability, and EVM compatibility have proved to be appealing features.

Morgan Krupetsky, Head of Institutions & Capital Markets at Ava Labs stated:

“Littio and OpenTrade exemplify how Avalanche’s technology can enable underbanked populations to access compelling products and services that are otherwise unavailable or untenable via traditional rails leverage. I’m thrilled to see OpenTrade’s RWA-backed yield products and ultimately real world businesses being built on the Avalanche platform.”

Users may use the Littio app to directly access OpenTrade’s USDC/EURC Yield Pots. Visit opentrade.io to learn more.