- Litecoin market cap grows by $1B as price reaches $119.64

- On-chain metrics show significant profit-taking by long-term holders

- Technical analysis suggests continued upward momentum despite selling

Litecoin has demonstrated remarkable strength in the cryptocurrency market, with its market capitalization expanding by $1 billion over the past week.

This 15% growth has pushed the price to a significant milestone of $119.64, a level not witnessed in two years. This price action has created an interesting dynamic between long-term holder behavior and ongoing market momentum.

Story Behind Long-Term Litecoin Holder Activity

The Liveliness metric, a sophisticated on-chain indicator, has reached a year-to-date high of 0.71, marking a significant shift from its November 1 low of 0.69. This LTC metric serves as a window into long-term holder behavior, measuring the proportion of coins in circulation that have recently moved.

The current elevated reading suggests that many veteran holders are choosing to realize profits after holding through extended periods of lower prices.

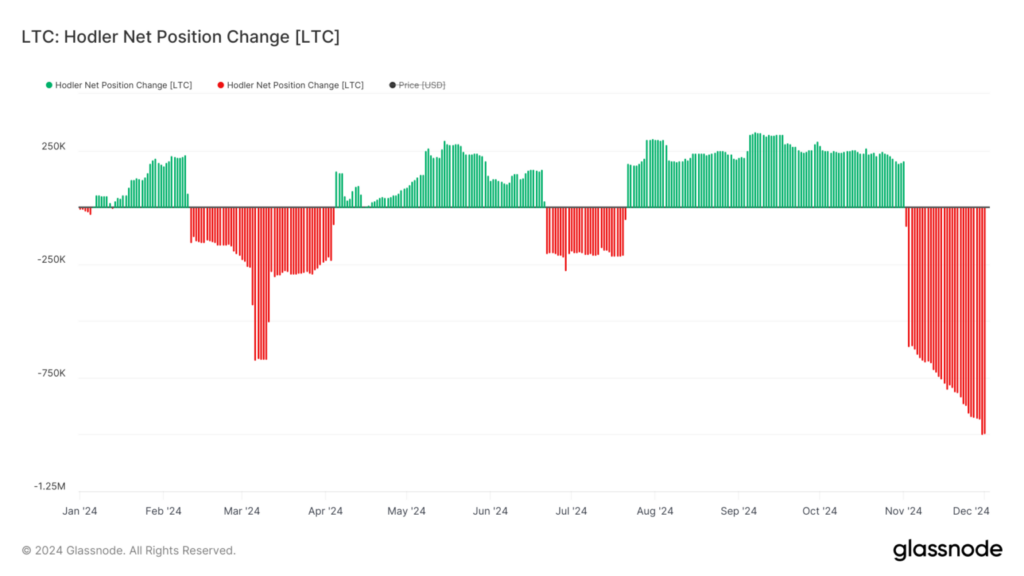

Further validation of this distribution trend comes from the Hodler Net Position Change metric, which has maintained negative values since November 2, reaching a year-to-date low of -993,199 on December 1.

This persistent negative reading indicates that long-term holders are reducing their positions at a rate that exceeds new accumulation, representing a significant shift in market dynamics.

Despite the apparent distribution phase from long-term holders, the technical structure of Litecoin’s market remains decidedly positive. The price continues to trade above the Ichimoku Cloud, a comprehensive technical indicator that combines multiple factors to assess trend strength and potential support/resistance levels.

This positioning above the cloud suggests that the current upward momentum remains intact and could potentially drive prices toward $143.41, a level last seen in January 2022.

While the selling pressure from long-term holders might typically be interpreted as a warning sign, the strong technical structure suggests that new buyers are readily absorbing this supply.

However, market participants should remain mindful of the $107.58 support level, as any significant increase in selling pressure could trigger a test of this zone. The interplay between long-term holder distribution and new buyer demand will likely determine the sustainability of the current rally.