- Kraken will remove USDT and four other stablecoins in Europe by March 31, 2025, to follow MiCA rules.

- Crypto.com and Coinbase are also delisting USDT and similar stablecoins to meet EU regulations.

- From 2025, hidden crypto holdings will be taxed, and businesses must report transactions under new rules.

Kraken to Delist USDT and Stablecoins in Europe

Kraken will remove Tether’s USDT and four other stablecoins from its European market to comply with the upcoming Markets in Crypto-Assets (MiCA) regulations.

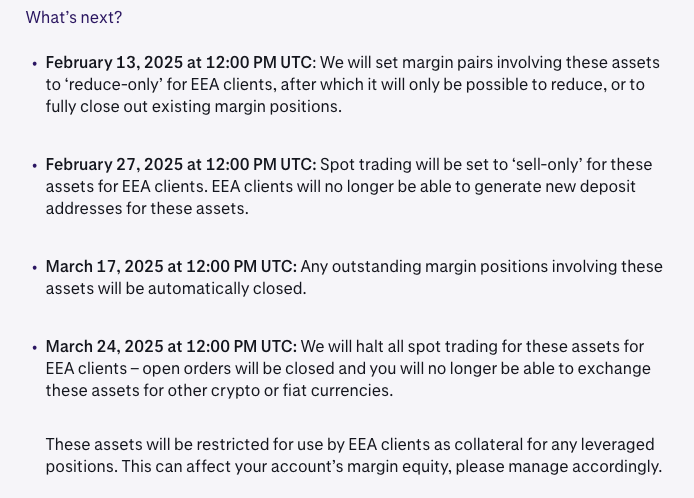

The delisting will happen in stages, with complete removal set for March 31, 2025. Along with USDT, the affected stablecoins include PayPal USD, Euro Tether, TrueUSD, and TerraClassicUSD. The process will begin on February 13, when margin pairs for these assets will be set to “reduce-only” mode. Allowing European users to close existing positions but not open new ones.

By February 27, trading will be limited to “sell-only” mode, preventing users from generating new deposit addresses for these stablecoins. Spot trading for these assets will be halted on March 24, and any remaining holdings will be converted into a different stablecoin by March 31.

ESMA has asked crypto exchanges to withdraw non-compliant stablecoins from their platforms step by step in order not to cause market disturbance. Other large exchanges, including Crypto.com and Coinbase, have begun delisting USDT and other similar assets.

Crypto.com will stop supporting ten stablecoins, including USDT, starting January 31, 2025, while Coinbase had already delisted eight tokens, including USDT, in December 2024. These actions align with the EU’s push for stronger regulations around stablecoins. Particularly to protect retail investors and ensure financial stability.

Crypto Exchanges Adapting to New MiCA Rules

Tether’s CTO Paolo Ardoino previously suggested that Europe’s strict regulations. Which could discourage stablecoin adoption and limit crypto access for retail investors. The new rules require businesses to report crypto transactions and correct errors within a 30-day period starting April 2026.

Undisclosed crypto holdings discovered in tax searches will be treated as hidden income from February 2025. Kraken, along with other exchanges. Which is making these changes to comply with regulations while continuing to serve European customers. As more platforms adjust to MiCA requirements, users are encouraged to convert their affected assets before the deadlines to avoid automatic conversions.

Highlighted Crypto News Today

PEPE Coin Struggles with a 60% Price Drop—Is a Rebound Coming?