- Community control, regarded as one of the key characteristics.

- KeeperDAO released two KeeperDAO Improvement Proposals.

In 2021, the fast-developing area of Decentralized Finance (DeFi) offered malicious players various vulnerabilities to syphon off earnings and tokens from unwary investors in the crypto world.

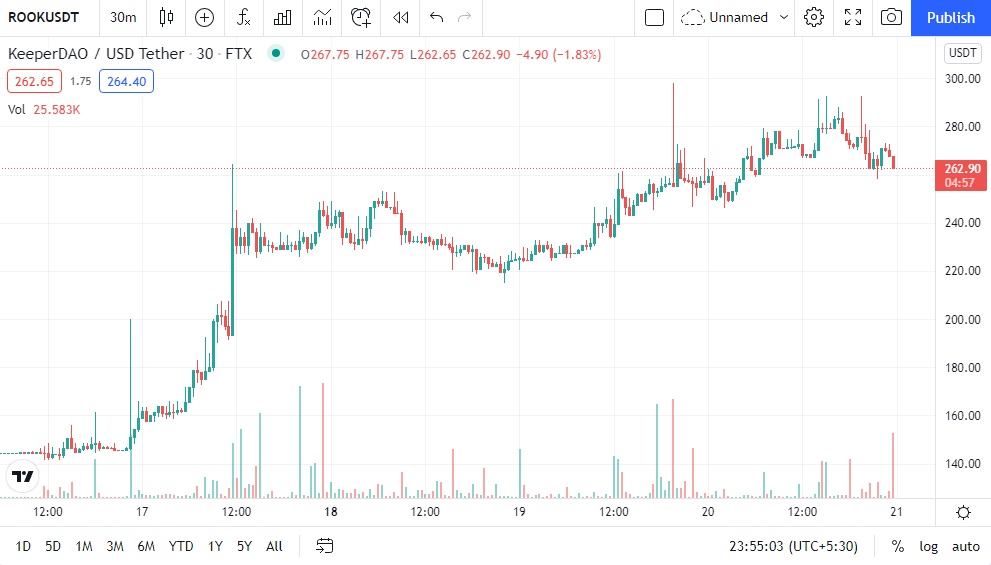

KeeperDAO, a DeFi system that protects users from Valuable Mining (SRM) robots that make upstream transact. It has grown by 118% in recent days. According to CoinMarketCap, since hitting a low of $ 124.70 on October 12. The price of ROOK has gained 118 percent to a daily high of $ 298. The release of community governance features, the increasing total value locked onto the system, and the potential of a new token buyback mechanism all contributed to ROOK’s price increase.

Community control, regarded as one of the key characteristics of a genuinely decentralized network. That a single group or organization does not control. Moreover, on October 4, KeeperDAO released two KeeperDAO Improvement Proposals (KIPs) that defined the easy framework for authoring KIPs and selected the first Sophons community group, which adds to the development of the community.

Furthermore, on October 11, both requests were approved unanimously, enabling the KeeperDAO community to start donating to the ecosystem.

Increasing Cash Flow

Moreover, another reason for ROOK’s rising popularity is the protocol’s increasing cash flow, which is currently nearing its May highs.

Furthermore, Dune Analytics estimates KeeperDAO’s total cash worth at $122.2 million and the protocol’s total asset values at $390 million. Also, the current governance votes concentrate on lowering ROOK circulating supply, reducing actor emissions, and financing development through the end of the year.

Recommended for You