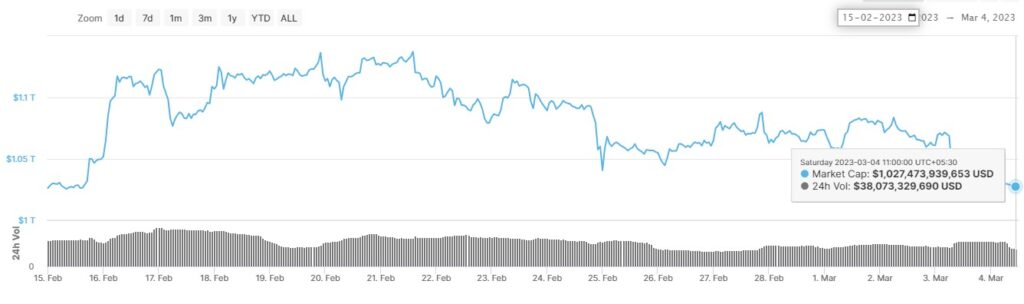

- The global crypto market cap declined from $1.13T to $1.02T in just 3 days.

- Bitcoin (BTC) dip to the 22K price range.

Another crypto industry giant Silvergate Capital is in danger of collapsing less than four months after Sam Bankman-Fried’s crypto exchange FTX and its sister company Alameda Research filed for bankruptcy. The global cryptocurrency market cap plummeted from $1.13 trillion to $1.02 trillion in just three days.

The warning spread throughout the crypto market sounds like a clap of new thunder. And Silvergate’s alarm is a trailblazer of recent chronological events in the crypto crash. Further, the cryptocurrency market loses more than $200 million in just four hours due to the significant liquidation.

Global Crypto Market is Under Pressure

The global crypto market witnessed a decline due to the top cryptocurrencies’ prices dropping late Thursday and early Friday, which was led by Silvergate’s recent statements. The bank claimed in a regulatory filing on Wednesday that it was “less than well-capitalized”.

Following that, it lost significant clients such as Coinbase, Bitstamp, Circle, and Paxos, who all declared Thursday afternoon that they would no longer utilize Silvergate’s banking services. Also, Crypto.com suspends Silvergate payments. However, now Silvergate stands on the brink of insolvency.

Bitcoin and other altcoins have signaled recovery since the start of the year. Also, BTC was traded in the 23K to 25K price range. Now the Bulls’ plan was disrupted, and the largest digital asset, Bitcoin (BTC), plummeted to its lowest point in two weeks. At the time of writing, Bitcoin traded $22,337, which declined by over 3% in a week and 9.2% in two weeks.

Further, the biggest altcoin Ethereum (ETH) price decreased by 2.5% in a week and 7.6% in two weeks and traded at $1,568. ETH 24-hour trading volume is also down by over 30.76%, as per CoinMarketCap data.

However, still, the cryptocurrency enthusiast and ‘SHIB Army’ positively await the much-anticipated layer-2 blockchain “Shibarium” launch.