- The White House Crypto Summit could trigger a “sell-the-news” event.

- Bitcoin price support levels are at $87,200 and $82,908, with potential declines to $70,000.

- The $92,000 short-term holder cost basis is key for determining momentum.

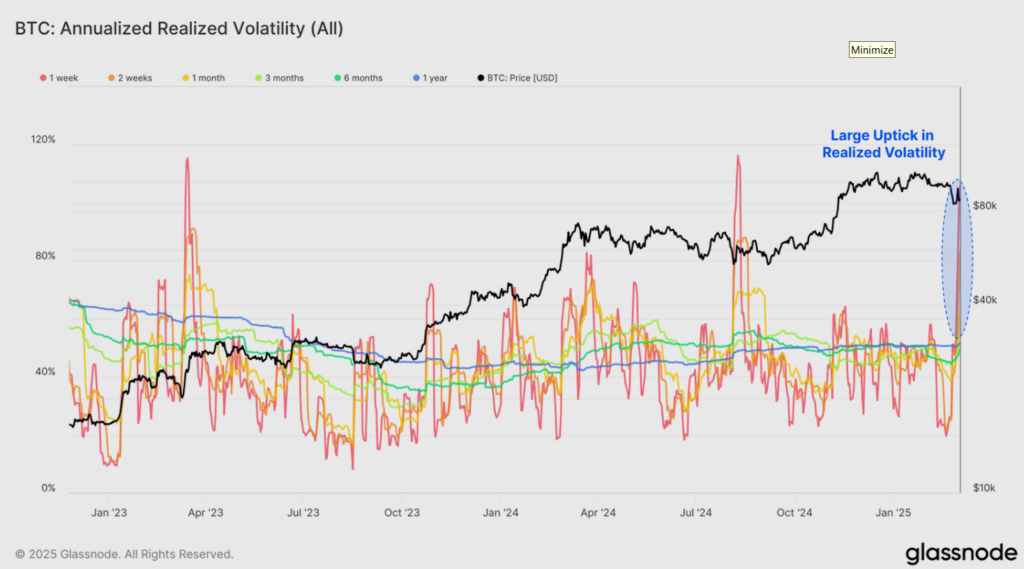

Bitcoin’s recent breakout of the $90,000 support level has increased fears of a potential liquidity grab under this crucial price zone. On March 6, Bitcoin (BTC) hit a high of $92,700, which represented a 19% rise from the February 28 low of $78,200.

The price rise fuelled optimism in the market. Bitcoin’s subsequent rejection at $94,500, however, has opened the door to the possibility of a further decline in the coming days.

The White House Crypto Summit’s Impact

Everyone waits with bated breath for the March 7 White House Crypto Summit. Ahead of a pro-crypto position from the U.S. government, there lies a possibility of bullish sentiment pushing prices upwards. Yet, there also remains a risk of a “sell-the-news” situation if the summits’ results fall short of market expectations.

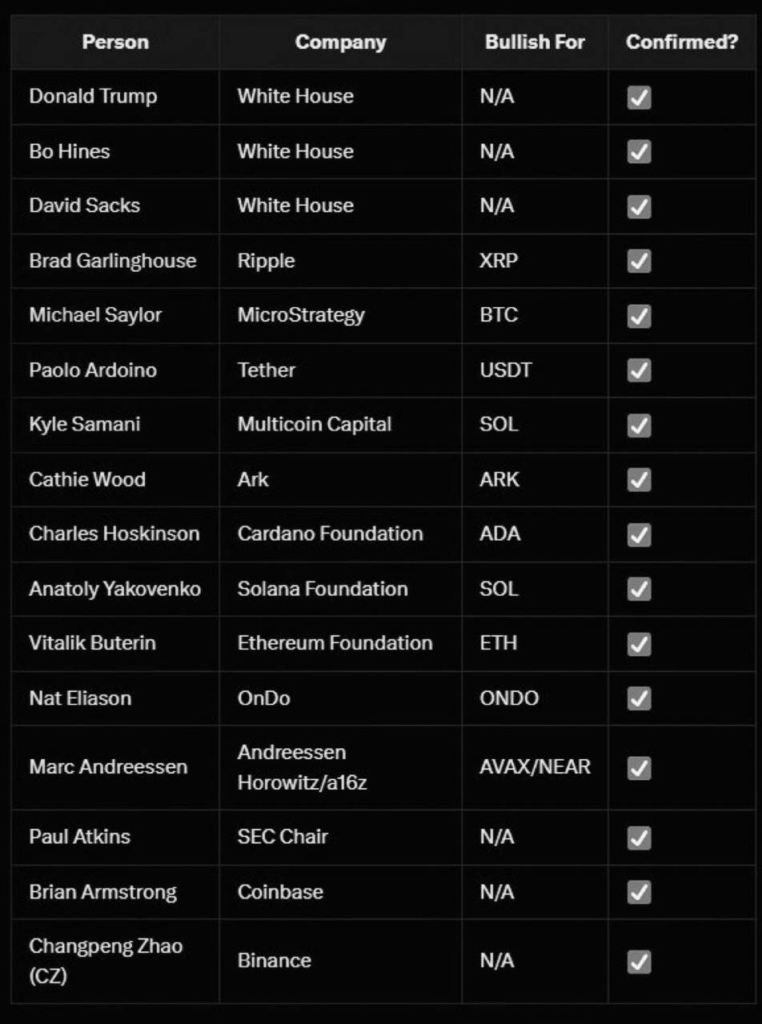

The summit, to be hosted by U.S. President Donald Trump, seeks to unite industry leaders to address important matters like regulatory policies, stablecoin regulation, and the place of cryptocurrencies in the U.S. financial system. Some of the prominent guests will be names such as Michael Saylor, Strategy founder, Brad Garlinghouse, Ripple CEO, and Brian Armstrong, Coinbase CEO.

Although the Trump administration has been friendly to the crypto space, the results of the summit are far from certain. Any overbearing regulatory actions, like strict KYC regulations or taxing unrealized gains, might have the potential to spook investors. Past crashes, such as the 2022 crash after Biden’s SEC crackdowns, demonstrate Bitcoin’s vulnerability to policy changes.

If the summit doesn’t provide the expected regulatory clarity or adds unforeseen compliance requirements, Bitcoin’s price could drop sharply by 20-30%, as seen in previous patterns. Such was the case after Trump’s release of a Strategic Crypto Reserve, where Bitcoin first jumped but eventually fell 15% from $95,150 to $81,483.

Important Bitcoin Price Levels

On March 6, Bitcoin briefly touched $92,000 before pulling back. Traders are now focusing on crucial support levels, especially in the range below $90,000, as Bitcoin may revisit these levels soon.

The key initial support area is at $87,200, then comes the 200-day simple moving average (SMA) level at $82,908. Below these prices, Bitcoin might aim for the cluster of liquidity in the zone of $81,463-$78,200, which had developed in early March and February, respectively. In case of a breakdown past the $90,000 level of support, these levels can prove to be the crucial areas, and an extension of losses may have Bitcoin challenging the band between $74,500-$75,800, with further extension towards the $70,000 level.

Conversely, Bitcoin is resisting at $92,000 and $97,400, where the 50-day and 100-day SMAs meet. Breaking through this resistance area would mark the termination of the current downtrend and potentially drive Bitcoin to new highs, with $100,000 and above in the sights.

The STH cost basis of $92,000 is still a level to watch. Glassnode analysts have pointed out that this level has been important in the past during bull market uptrends. If the market continues to fall, the $71,000 area is an important area to watch. The active realized price at $70,000 also coincides with the lower band of the STH cost basis, making the $70,000 level an important support area.

Though Bitcoin demonstrated strength and hope after recent price fluctuations, these major factors like the White House Crypto Summit and future regulatory changes may actually decide the short-term path of the market.

Highlighted Crypto News Today

Michael Saylor Advocates for a U.S. Bitcoin Reserve at White House Crypto Summit