What is it?

MEV (Miner Extractible Value or Maximal Extracticle Value) is the income miners can make by changing the order of transactions according to their benefit. They can strategically order transactions within the blocks they mine and use various techniques to make more money. This practice has become so common among miners that hundreds of millions of dollars worth of Ethereum has been extracted via MEV.

Types and Examples

There are plenty of strategies that miners and validators can use, often simultaneously, to extract gains via MEV. Let us look at some of them.

Front-running is a technique wherein one tries to profit from knowing about upcoming transactions before they happen. Imagine you had insider information that a stock would shoot up and buy it. When the price of the stock rises, you can see it if you wish to, and you’ll make a profit. This is exactly it.

Miners and validators constantly scan the list of upcoming transactions called the mempool. When they spot a potential opportunity (a large transaction), they put their transactions in the queue with a higher fee so that they are processed before the original transaction. Once the original transaction is carried out, the value of the item they purchased will rise.

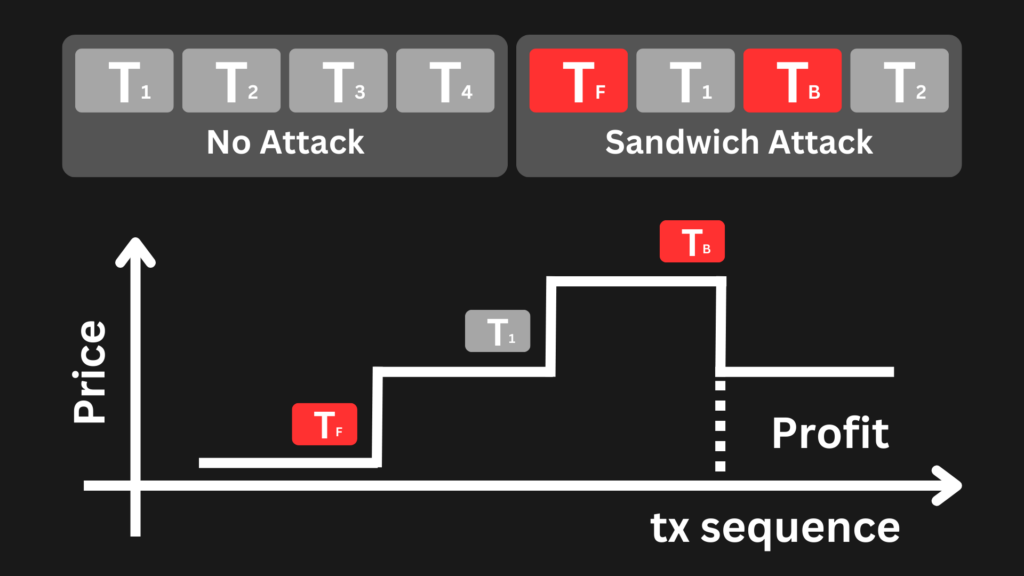

Sandwich Attack combines front-running with back-running, which means the attacker places two transactions – one before the victim’s transaction and one after. Before the big transaction goes through, the attacker buys the asset, causing its price to go up. Then, after the big transaction pushes the price even higher, the attacker sells the asset back at a profit.

To avoid these tricky maneuvers, traders resort to using DEX aggregators, adjust their slippage tolerance, or opt for some private trading channels.

Liquidations – If you borrow to buy a certain cryptocurrency, and its value goes down, you may need to sell your assets to cover the losses. When the value of the cryptocurrency goes lower than your collateral, any third party (such as an MEV bot) can buy the collateral at a discount, thereby getting an opportunity to resell it at market price for a profit.

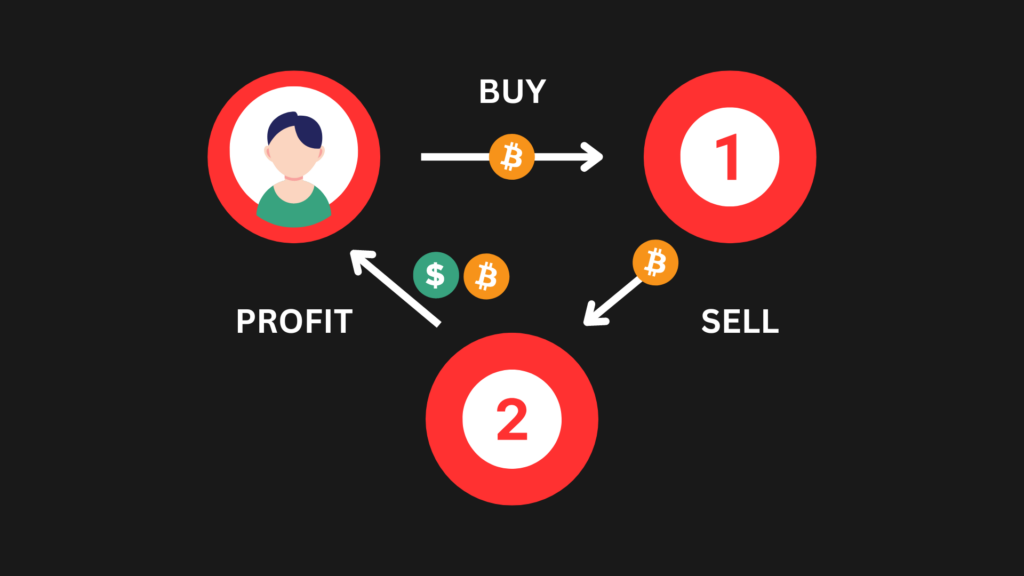

Arbitrage – When you find a good deal in different markets and profit from the price differences, it’s called arbitrage. There are multiple cryptocurrency exchanges, and one can buy a cryptocurrency at a lower price on one and sell it for a higher price on the other.

For instance, if Ethereum is priced at $1995 on one platform and $2005 on another, an arbitrager can buy it at the lower price and sell it at the higher price, making a profit of $10 per Ethereum (after subtracting the fee).

Bundled Transaction Processing – MEV bots can do this to make their transactions more efficient. Be it for a sandwich attack or arbitrage, MEV bots will have to place a lot of transactions. Grouping multiple transactions and executing them simultaneously gives them an edge by lowering gas fees.

For example, if an MEV bot detects an arbitrage opportunity, it can send two transactions that will complete the arbitrage opportunity directly into the mempool or to a block builder. Sending these transactions as a bundle offers searchers a significantly greater chance of success than using the mempool. This is because bundles allow searchers to provide higher direct payments to validators for the same MEV opportunities.

The list doesn’t end here, of course. As the cryptocurrency landscape evolves, new approaches will keep emerging.

Impact

MEV is a highly debated concept in the crypto world. While it can provide opportunities for profit via the strategies we just discussed, it also raises concerns about fairness, market manipulation, and the overall health of decentralized systems.

In a recent press release from ZENMEV, it was stated that profits of over 675 million dollars were realized in 2022 on Ethereum alone. If other blockchains like Solana, Binance Smart Chain, and so on are taken into account, this number exceeds one billion dollars.

The Good:

MEV incentivizes miners and validators to optimize transaction ordering, eventually leading to more efficient markets and improved protocol performance.

MEV bots maximize the value of a block by selecting the most profitable transactions to include in it, and this affects the value of the entire network. By optimizing a block and achieving its highest value, the value of the entire network is increased. When done in a balanced manner, this can lead to enhanced network security, increased blockchain utility, and more efficient markets and secure operations.

Through beneficial transactions like arbitrage, liquidations, and privacy enhancements, economically motivated actors can help reduce inefficiencies within protocols, improving the efficiency and resilience of the DeFi ecosystem. This ensures fair prices for users across exchanges.

Additionally, MEV encourages miners or validators to actively participate in the competition for block production, thus strengthening the network’s overall security and stability.

The Bad:

Naturally, there is a lot of criticism towards MEV for enabling unfair advantages, distorting market dynamics, and creating risks for users and protocols. Unfavorable trading conditions caused by substantial slippage during trade executions are eroding the trust in blockchain platforms.

Also, as frontrunners pay higher gas fees to ensure prioritization of their transactions, the network congestion increases. This means that transaction costs rise for all the participants in the network and even lead to degradation of the network’s efficacy due to slower processing of transactions.

The Silver Lining:

There are some efforts to mitigate the impacts of MEV. For instance, a project called Flashbot distributes MEV gains among participants. There are also protocols designed to find the best prices for trades across all the available exchanges and aggregators.

The Bottom Line:

MEV helps users optimize the value of a block, which in turn increases the overall value of the network. It enables beneficial transactions and encourages miners or validators to compete for block production, making the network more secure and stable. However, it can lead to challenges like increased gas prices and potential network instability if not managed properly.

The information in this article has been provided to you by ZENMEV, a research and development group that is leading the cause of mitigating the risks involved with MEV.

Disclaimer: TheNewsCrypto does not endorse any content on this page. The content depicted in this press release does not represent any investment advice. TheNewsCrypto recommend our readers to make decisions based on their own research. TheNewsCrypto is not accountable for any damage or loss related to content, products, or services stated in this press release.