- Major institutions have disclosed their investments in spot Bitcoin ETFs through their latest SEC 13F filings.

- JPMorgan and Wells Fargo are the prominent disclosures on the list.

Disclosures from major institutions and banks regarding their investments in spot Bitcoin ETFs have emerged after the first quarter ended. Noteworthy are the disclosures from industry giants such as JP Morgan and Wells Fargo on Friday.

According to data, banking giant JPMorgan Chase holds spot Bitcoin ETFs issued by BlackRock, Fidelity, Grayscale, Bitwise, iShares, and ProShares. Meanwhile, Wells Fargo opted for spot Bitcoin ETFs issued by ProShares and Bitcoin Depot.

Investment and trading firm Susquehanna International Group, LLP (SIG) has invested $1.8 billion in these funds. Primarily, it allocated $1.09 billion to Grayscale’s GBTC. Moreover, custodian banks such as BNY Mellon and BNP Paribas have also purchased BTC ETFs. The list of firms exposed to this asset includes Hightower, US Bancorp, Edmond de Rothschild, Rubric Capital Management, SouthState, and others.

Current Stance of the US Spot Bitcoin ETF Market

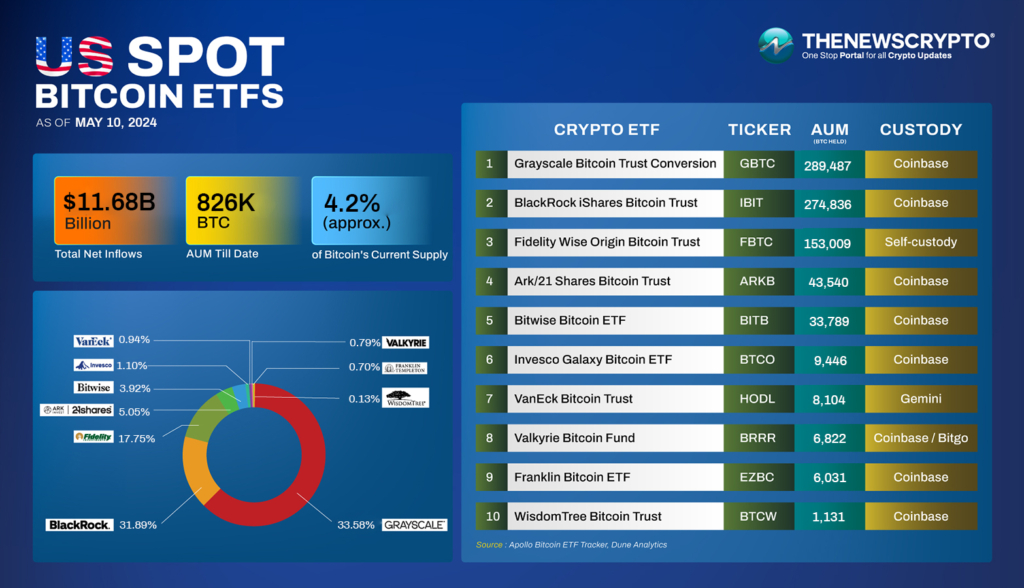

Overall, the assets under management (AUM) of the eleven ETF issuers in the US exceed $50 billion. These entities manage over 4.2% of the circulating Bitcoin supply. According to ETF tracker SoSo Value, this market has recorded a total net inflow of over $11.68 billion. On Friday, it noted a net outflow of $84.66 million.

The dominant player, Grayscale, holds nearly $17.6 billion of BTC under its GBTC, while BlackRock manages $16.7 billion under IBIT. Meanwhile, others such as Ark hold $2.6 billion, VanEck with $575 million, and Invesco with $415 million.

Since January, BlackRock’s IBIT has observed maximum inflows of over $16 billion. Fidelity’s FBTC has a second cumulative inflow of $8 billion, while Ark’s ARKB and Bitwise’s BITB stand with $2 billion.

As of May 10, the total value of spot Bitcoin ETFs traded in the US markets was $2.05 billion. On Friday, over $84.6 million in outflows was recorded. At the time of writing, Bitcoin (BTC) traded at $60,700 after a decline of % in the last 24 hours.

Highlighted Crypto News Today

ARK Invest and 21Shares Drop Staking from Proposed Ether ETF